What common predictors of success set apart prosperous market entrants, and how can you ensure a resounding market entry for your own company?

However, practical steps can be taken to help executives control their cognitive biases when making major decisions about market entry. Objective predictors of success can be analysed, then measures can be taken to ensure your own company will shape up come market entry.

Market penetration is a crucial indicator of how effectively your market entry strategy is being implemented. Simply put, market penetration is the proportion of identified potential customers in your targeted niche that you have actually gone on to acquire.

If you are failing to meet your desired penetration rate, it might not only be because of a strategic issue with sales or marketing, but also perhaps because you have neglected to fully develop your market entry strategy in your rush to expand your potential customer base.

As a UK car manufacturer that has recently moved into the electric car market, let’s say you have sold 10,000 models of your new vehicle, while in the UK to date 301,000 electric cars have been registered to drive on our roads.

Penetration rate = (301,000 ÷ 10,000) × 100 = 3.3%

If your business is proficient not only at marketing but also at retaining clients and sales, you may face the interesting problem of having become saturated within your chosen market; that is, you will have hit the maximum penetration rate.

In order to continue growth you will need to expand the size of your prospective market.

Understanding the size of a potential market generally entails categorising customers, then leveraging pricing and assumptions of elasticity to estimate the percentage of potential buyers per category whom the company may realistically capture. Two biases can distort these estimates, however:

1. It is a human tendency to be overly optimistic when considering positive outcomes that are yet to happen.

2. Executives may fail to sufficiently adjust estimates from an initial value, regardless of where it came from.

One particularly useful way of improving your estimates of the market size is leveraging the reference class of previous entrants as a benchmark.

Allied Market Research have forecasted the market share of various forms of clean energy across the total global renewable energy market. Based on figures from 2017 they forecast that the relative usage of each form of clean energy will remain the same by 2025, but that hydroelectric energy growth will rise considerably compared to other clean energies, becoming the obvious frontrunner in the clean energy market.

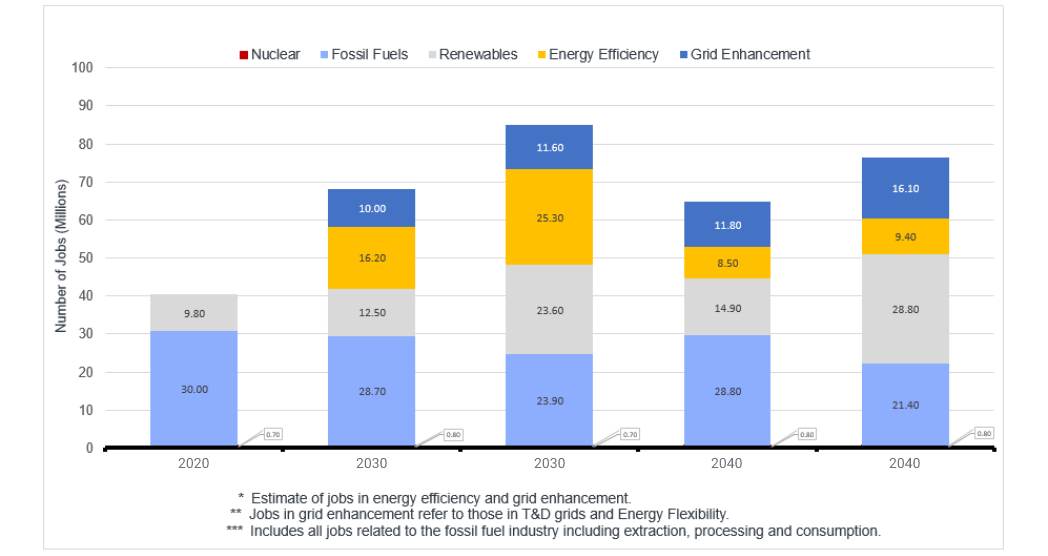

IRENA, Global Energy Transformation Report 2018

Behavioural profiling allows us to understand the character and traits that make up an individual’s behaviour. Understanding the way partners and competitors will act as a result of your organisation’s market entrance can mitigate the previously unknown risks of market entrance.

Because B2B markets have complex decision making units, your organisation will be talking with lots of different individuals, making it harder to segment your audience than in B2C markets, where businesses often profile the main purchaser of a family unit. There’s an argument for profiling the companies of your competitors or partners, alternatively you can profile specific individuals instead.

Sometimes key individuals have such a significant influence that they are considered a segment to themselves. If this is the case in your market you can create behaviour profiles for these key individuals to help you understand their potential decision making process.

Precise cost estimates can prove crucial in your efforts to create value. Yet so many businesses fail to arrive at cost estimates that have even a semblance of adequacy, and it’s usually down to the so-called planning fallacy, whereby executives underestimate the cost and duration of a given endeavour. Even a relatively routine process for an established and prosperous company can be devastatingly mismanaged if expenditures transpire to dramatically exceed those forecast.

If you are a market entrant and your reference class is sufficiently broad, it can negate the impact of the planning fallacy by affording you a realistic range of expenses associated with accruing various levels of market share.

Cost estimates significantly below those realised by the reference class should clearly signal to the decision-makers of your company that they need to exercise greater caution in the future.

For oil conglomerates, the opportunity to expand is continuing to become narrower at a rapid pace, due to ever depleting oil reserves and the competitive market landscape.

Neptune Energy has tackled this conundrum by transitioning away from oil-based energy to cleaner forms of energy, for which there is growing demand. Their PosHYdon pilot project, the world’s first offshore green hydrogen project, is part of their strategy to position themselves as a prominent figure in the clean energy transition. Their partnership with Eneco for this project means Eneco can supplement the project with data from its offshore wind farm, Luchterduinen, located off the coast of the Netherlands, while Neptune Energy can gain valuable experience of integrating working energy systems at sea and producing hydrogen in an offshore environment.

In addition, Neptune Energy announced in 2020 their support of the EU's hydrogen strategy by joining the European Clean Hydrogen Alliance. Initiatives and efforts such as this continue to pick up pace, due to public demand and the ambitious global emission reduction targets of the Paris Agreement.

This is just one example of how an organisation can leverage expertise and data to inform strategy.

Other leading oil firms could follow suit, being well placed to transition to producing hydrogen energy at sea. They will need to focus their attention on repurposing existing offshore infrastructure to do so. However, with infrastructure already in place, oil firms could have an advantage over brand new entrants without the existing established infrastructure systems in place to move quickly.

Only by continuously checking where you are with regard to both the market and the competition will you take a successful market entry and turn it into a longer-term prosperous business model.

Successful market entries often hinge upon the entrant’s scale relative to its competition, its capacity for leveraging complementary assets and — perhaps foremost — its timing. Moreover, the gravity and magnitude of decisions executed at the point of entry, encompassing diversification endeavours and geographic expansion, should prompt detailed analysis—even when you are winning.

Tell us about your business challenge or a particular type of knowledge/expertise you require.

Within 48 hours we present a customised shortlist of Experts, specifically matched to your project.

Connect directly with selected Experts in whichever way works best for you.

Transfer Experts' unbiased, practitioners' perspectives into actionable plans that drive business growth.

Head of Strategy and New Ventures

Digital Transformation Program Lead

Natural Resources Business Development Director

VP, Strategy

"Pangea SI is the only platform dedicated to helping businesses access the information they need to accelerate their decarbonisation and energy transition initiatives in an economically viable way."

Pangea SI's on-demand consulting platform has transformed the results of businesses worldwide.