Admitting your business is in crisis is the first step toward making changes — but you will need a well thought turnaround strategy.

Feel free to navigate to the section which proves to be the most compelling for your business use case. We know our readers are busy, so we welcome you to read at your leisure.

• The three stages of decline

• Stakeholder communications

• Restructuring

• Financial position

• Fostering a culture of change

The struggles of distressed businesses can be brought upon by extraneous marketplace forces and in many cases misguided strategic decisions. By understanding a number of rudimentary turnaround tactics leveraged by crisis and risk management firms, you can hone in on your company’s shortfalls and save it before passing the point of no return.

Strategic Crisis

During the first stage of a crisis, sometimes referred to as the strategic crisis, the company can no longer compete effectively. Sales may be stable, perhaps even growing, but profitability will have begun an inexorable decline. This may be because management experimented with a novel strategy — or several permutations thereof — without success. Worse still, this same management may be unaware — or worse, ignorant — of the damage that said strategies have wreaked.

Come the liquidity crisis, management generally lose the ability to employ changes on their own terms, and are instead obligated to look to stakeholders, including creditors and banks, to have a say in restructuring.

If it has to come to this for your company, meet with your stakeholders and elucidate in no uncertain terms precisely what you need from them.

You may need to consider the very real possibility that one or several members of senior management must be changed out.

They needed to change something so they bought in a new CEO. Lou Gerstner was hired to turnaround the flailing company. Gerstner led the firm to invest in software lines and IT services. They are now worth more than $210 billion.

So, how did he do it? IBM’s board of directors weren’t looking for a technical expert, rather someone well versed in change management.

He had demonstrated these skills at RJR Nabisco by bringing together two separate workforces which were part of the company after a merger. Gerstner used his experience of listening to different groups at IBM:

• He started by interviewing the different teams to understand employees better;

• He then talked to customers who reported the same issue — that they were disappointed in IBM’s change of approach from being an all-in-one solution for information services.

Gerstner returned to the old approach and won back customer goodwill.

In practice, very few managers are genuinely incompetent, but it remains true also that a manager must own the decline the company has faced during their tenure. Maybe they were incapable of the shift in mindset required to implement fundamental alterations to the operating philosophy they have adhered to for so many years. It can be hard, but removing such members of the senior management team - as demonstrated - from the equation sends a clear signal to your stakeholders: we are effecting change, and we’re not afraid to make tough calls as we bring that change about.

Turning around a business crisis inevitably entails assessing how it is arranging its functions, units and supply chain.

You may well conclude that you need to effect significant changes, including consolidating or realigning units, divesting or closing non-core divisions and blue-sky-thinking other ways your business could create value. You will also need to determine how to most effectively revamp operational processes in order to support the restructuring.

Rethinking these processes from the ground up will enable your company to retool them to deliver greater cost efficiencies, with regard not only to material but to personnel, too.

In response Kansai decided to run all of their thermoelectric generators and hydroelectric generators at 100 per cent capacity to compensate for the lost energy production. It also leaned on its customers to save energy where possible to prevent power cuts. During this time the price of oil and natural gas rose increasing the company’s costs and additionally there was much speculation that deregulation of the Japanese nuclear industry was approaching.

Kansai’s turnaround focused on improving efficiencies. This included engineering operations, replacing power lines and transformers and investing in R&D. In 2014 they introduced upgrades to one of their power plants, which resulted in efficiencies of $372 million.

The result of these and other changes were marked. Kansai’s net income bounced up to $1.2 billion in 2016 from -$2.2 billion in 2013.

Consideration points

As soon as an impending crisis has been identified (or as soon as management have finally accepted that a crisis is, in fact, occurring right now), the company will need to conduct thorough financial due diligence: review its cash reserves, credit availability and cash flow.

This will give you a clearly projected timeframe, as well as a deadline after which you would unavoidably have to shut up shop. Assessing your finances will be of immense use as you calculate whether you have time to implement long-term changes that will help turn the business around, or if immediate steps must instead be taken to cut expenses and bring in cash immediately.

Your financial trigger points should be oriented both to cash flow and financial metrics, as well as to market and operational performance.

Take a cold, objective look at where you are as a business by considering basic milestones, then look at your position with respect to both your competitors and your industry. Reflect on your performance over previous cycles to identify trends. If KPIs were consistently missed, you need to be asking serious questions. And if you’re failing to move with the industry—or indeed struggling to keep pace even when the industry itself is floundering—then your plans for prosperity may have already obsolesced.

You will need to consider the financial implications of your decisions with regard to structure, operations and strategy. The business’s future target state should be summarised in a comprehensive plan, including P&L, balance sheet structure and cash flow statement. Quantify the benefits that each measure will deliver to the bottom line.

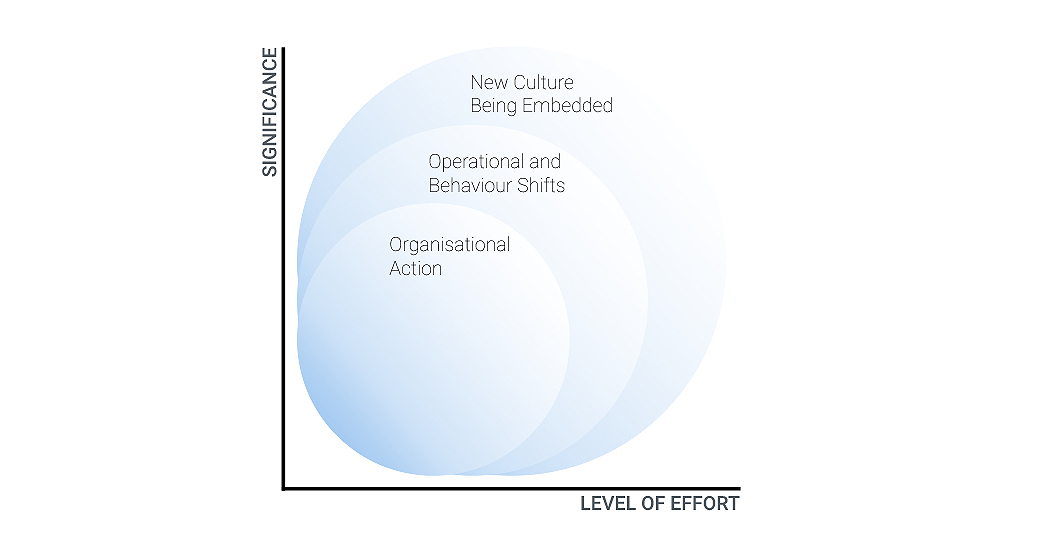

Your overarching strategy will need to translate into an actionable business model, complete with corresponding shifts in how both the products and the business itself will go to market—and all with the objective of boosting sales. By nurturing an organisation-wide culture of change, you can actively build support for and commitment to the implementation of strategic initiatives.

If you do not address and fix the fundamental problems with your company, some short-term reductions in expenses or a temporary cash injection will only bury those issues for longer. Unless your company has suffered an extraneous, anomalous problem, such as embezzlement, economic recession or an epidemic, your struggles could be down to your demand generation strategies or sales operations. Consider the value you are offering, the fit with your target markets, price points, branding, promotional strategies, and distribution methods.

The first step toward turning around a business in crisis is acknowledging there is a crisis. This is not tantamount to an admission of failure; rather, it is an unambiguous signal of dynamic, proactive leadership to stakeholders and staff alike. Some of the most successful businesses in history have changed up their CEO or worked with crisis management firms to reverse their fortunes — and they’ve come out all the stronger for their strife. As long as the conversation is open, honest and forthright, it might not be too late.

Tell us about your business challenge or a particular type of knowledge/expertise you require.

Within 48 hours we present a customised shortlist of Experts, specifically matched to your project.

Connect directly with selected Experts in whichever way works best for you.

Transfer Experts' unbiased, practitioners' perspectives into actionable plans that drive business growth.

Head of Strategy and New Ventures

Digital Transformation Program Lead

Natural Resources Business Development Director

VP, Strategy

"Pangea SI is the only platform dedicated to helping businesses access the information they need to accelerate their decarbonisation and energy transition initiatives in an economically viable way."

Pangea SI's on-demand consulting platform has transformed the results of businesses worldwide.