Last revised: March 20, 2020

Expert Bio:

With more than 16 years of experience in various positions within the financial sector, this Expert has gained strong credit expertise mainly in roles within the savings banks and cooperative banking sector. In addition, he worked for a US financial investor.

In his role as management consultant, this Expert supports banks in the development and implementation of new business models and the implementation of regulatory requirements. He is also the contact person for Sustainable Finance and Impact Banking. He is a member of the ABBL Sustainable Finance working group.

A trained banker, this Expert holds a Bachelor of Science in Management and Financial Markets, a Master of Laws in Mergers & Acquisitions, and a degree in Banking Management from a well-respected School of Finance and Management. This also includes professional aptitude in the sense of §25c Abs. 1 KWG. In addition, he teaches Business Administration at the aforementioned institution and regularly supervises final theses in the academic field as a second assessor. He is currently balancing his career with studying as a PhD student.

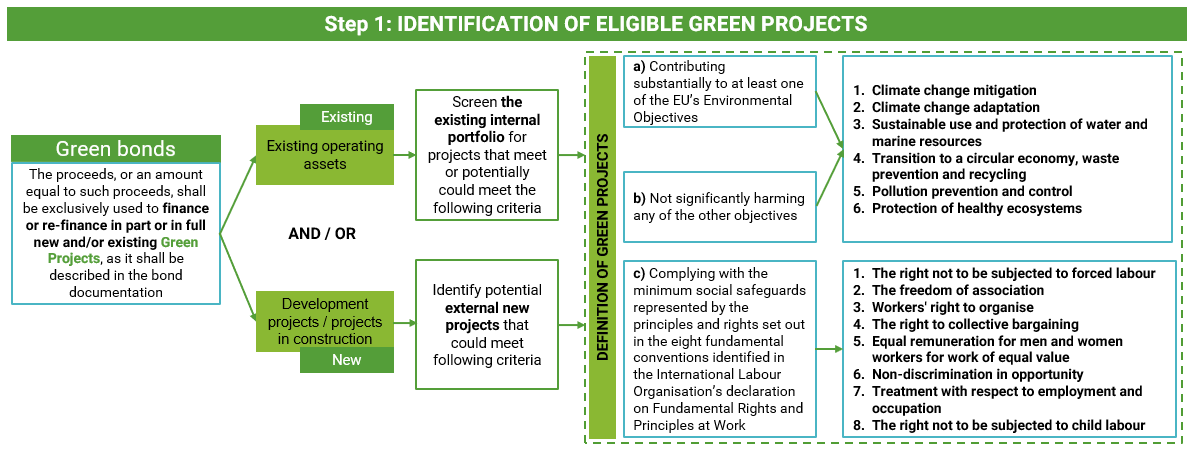

The term “green bond” refers to debt securities whose proceeds are used to finance investment projects with an environmental benefit.

As defined in the EU Taxonomy, COM 353 (2018)

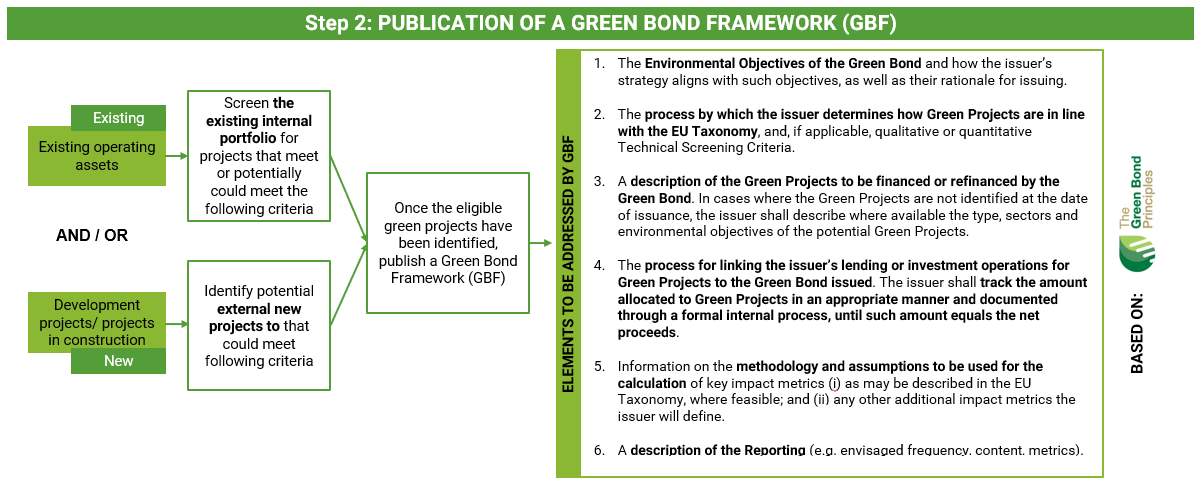

The Green Bond Framework is a comprehensive document for investors and other market participants that describes the following points:

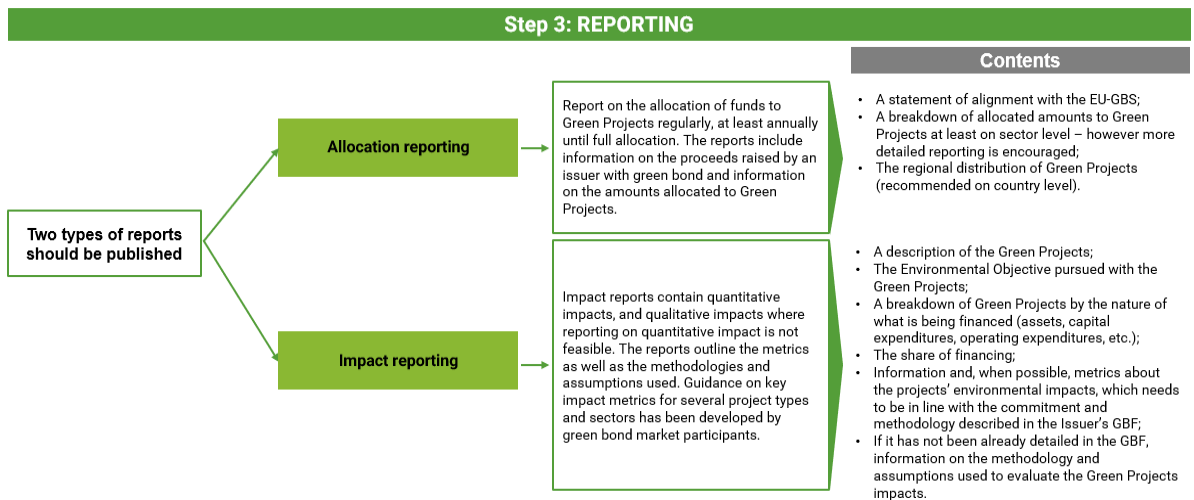

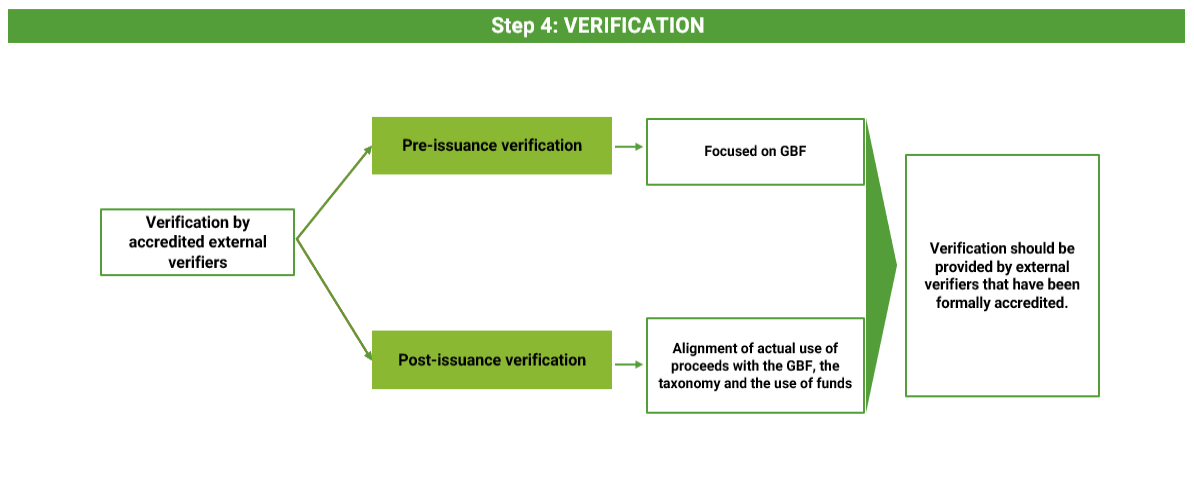

Source: Report on EU Green Bond Standard, EU TEG (June, 2019)

This guide was provided by a sustainable finance Expert with nearly 20 years of consulting experience.

Contact Mr Callis on 020 7551 0782 or by email [email protected] to connect with this Expert.

You can register for free. It is quick and easy and once registered you will get full access to all our premium content.

Just log in and learn, then absorb content covering: