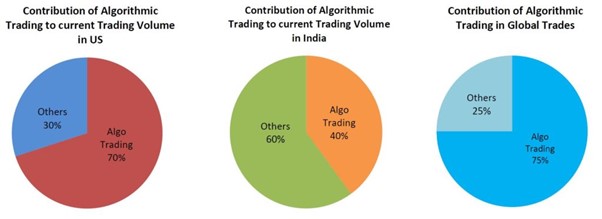

Main geographic locations that use algorithmic trading:

Algorithmic trading is a process of executing trading orders using automated pre-programmed trading instructions. It takes variables such as time, price, and volume into account. Algorithmic trading aims to use speed and accuracy that’s greater than a human to increase returns.

Algorithmic trading has always been an issue for financial regulators such as the Stocks and Exchange Commission (SEC). Using machines and computers to generate profits at speeds and accuracy that no human could ever achieve does raise some ethical questions and regulatory issues. As regulators look deeper into algorithmic trading, companies need to carefully monitor developments in regulation and adjust their systems accordingly.

In 2019 the Hong Kong Monetary Authority reviewed automated trading activities. From this, they produced a regulatory document that asks that all firms should align their policies and processes with the regulator when using algorithmic trading strategies. Firms are expected to also have an inventory of their algorithms and formulas being used and firms are expected to develop their own policies.

In other nations across Asia, continuous study of algorithmic trading and the impact it has on the financial markets is taking place. For example, The Bank of Japan has produced and published a document of their thoughts on the impact of algorithmic trading on market liquidity and they want to deepen their understanding even further. This can allow the correct and suitable regulation to be put in place.

In the United States of America, the SEC produced a report stating that the need for continued monitoring on the advancements in technology and algorithmic trading is required. The SEC appear to have mixed views towards algorithmic trading but have concluded that “updating of systems and expertise will be necessary to help ensure that our capital markets remain fair, deep, and liquid.”

In December 2020, the European Securities and Markets Authority (ESMA) released a paper on algorithmic trading with an opinion to update the Markets in Financial Instruments Directive (MiFID II) in accordance with modern technologies and systems. However, for now, in the short term, the regulation in Europe is likely to remain the same. The MiFID II already imposes strong compliance and regulation on firms using automated trading.

In the UK, the majority of the MiFID II was transformed into domestic law because of Brexit. This means that firms under the FCA must obey the rules including conducting real-time monitoring of algorithmic trading activities that takes place. In the future, it is suspected that the FCA like the EU will look for further regulation on algorithmic trading to ensure the financial markets remain fair and liquid.

There are many benefits of algorithmic trading and not just speed, frequency, efficiency and volume of order entry. Algorithmic trading eliminates one of the biggest factors that affect human traders – emotion. Emotive trading can be very costly for anyone and will always be the weak point of human traders as our emotions will not disappear.

Producing rules and algorithms and applying them means trades are performed solely on data and live-market information. This removes any impulse or irrational buying/selling.

The main attributes of algorithmic trading help keep discipline and focus even in volatile, unpredictable, and depreciating markets. When a trade rule is established and configured in advance and traders have little time for interpretation of the market, the consistency of their trading strategy and rules can be upheld and are not impacted by irrational thinking or impulse decisions.

Algorithmic trading also allows for the opportunity to test your trading strategy before applying them to live markets. You can apply your rules/algorithms to historical data and market scenarios. From there you can build data that showcases systems in the correct context, but it also enables the fine-tuning of a strategy and algorithms to ensure they are correct.

Algorithmic trading may remove the costly impacts of emotion in trading, but it also makes investors and traders rely solely on technology and the systems that they create.

This may not always be an issue, but it can cause difficulties if the algorithmic trading system is set up on a computer as appose to a server. If this is the case, internet connection issues or a network crash could stop orders from being filled and result in missed market opportunities.

If your strategies are in fact integrated on a server or online trading platform, at the minimum one needs to track their trades to ensure that they’re being filled.

In addition, you should also know of the risks of over-optimization. This can lead to algorithms that are very streamlined and look amazing on paper or in practice but fail in real market conditions. With over-optimization, too much time is spent refining strategies based on test results or historical market data. But in reality, the system is unable to perform and achieve results in live market conditions.

There are endless possibilities for algorithmic trading going forward. These are some of the possibilities we may see within the algorithmic trading market in the not to distant future:

Machine learning combined with the possible technologies below could open a very different future for trading and algorithmic trading:

– The use of nanotechnology in trading

– Microchips that allow orders to be executed as fast as 74 nanoseconds

– Microwave transmission technology could allow data to be transmitted at the speed of light

Algorithms will therefore provide better pre-trade recommendations into the performance of all available algorithms. This means traders will be able to use the correct algorithm and also use of an increased range of strategies. These intelligent pre-trade recommendations will enhance pre-trade confidence.

The main markets for algorithmic trading:

| Foreign Exchange (FOREX) FOREX is a global ‘decentralized’ or ‘over-the-counter’ market for trading currencies. The FOREX market determines exchange rates for every currency in the world. It is one of the most actively traded markets and due to its often-unpredictable and volatile nature algorithms and algorithmic trading can be highly beneficial to traders. |

Stock Markets The stock market is all the markets and exchanges where regular activities of buying and selling of publicly traded shares in companies takes place. Being one of the most popular financial markets, traders often use algorithms based on their trading strategies increasing the accuracy and speed of their trades. |

| Exchange-Traded Funds (ETFs) An ETF is a type of investment fund that is traded on stock exchanges. They are built up of various individual stocks and often a great way for investors to gain exposure to a wide range of bonds and shares. Algorithmic trading is used for trading ETFs however, most ETFs are used as long-term investments making them less popular for algorithmic trading then the stock market or FOREX. |

Bonds A bond is a payment made by an investor to a borrower (company or government). Algorithmic trading in the bond market is not uncommon but due to bonds unique nature with every bond have different specifications like interest rates, maturity periods, terms, and conditions. Algorithms must consider yield-to-maturity, yield-to-call, actual yield, credit grades, and more to assess a good bond from a bad one. This requires complex and well-practiced algorithms. |

| Cryptocurrencies A cryptocurrency is a digital/virtual currency in which transactions are completed via a decentralised system like Bitcoin or Ethereum. The cryptocurrency market is extremely volatile and very unpredictable. Algorithms allow traders to trade automatically when ‘coins’ hit certain prices. Due to the vast volatility of this market algorithmic trading can be extremely profitable but can also lead to great losses if the algorithm is not perfect. |

Others The markets for algorithmic trading are endless including commodities such as gold or oil, Credit Default Swaps, Interest Rate Swaps, and Derivatives market. The applications and uses of algorithmic trading come in all different forms and sizes with each carrying its own benefits and risks. |

More Confident Investment Decision Making

Expect to make truly informed, risk-reduced decisions. 100% of our clients believe our platform has enabled them to “increase the speed of their early-stage research into new areas.”

Insights On Demand – in as little as 48 hours

You can access subject matter experts from anywhere in the world, whenever you need them. When technical challenges or commercial projects arise which need specific results, you can obtain valuable consulting recommendations from vetted Experts.

Commercially Effective Research

Your research capacity and capabilities are augmented through Pangea SI Experts – there is no need for hefty strategy/management consultancy retainers and you can forego the process of having to hire someone full time.

1

Clients notify us that they need leading insight for their project.

2

We engage and vet subject matter Experts matched to the request at speed.

3

Clients consult with their shortlisted Expert(s) and obtain forward knowledge to incorporate into their strategic plans.

4

Clients benefit from more refined analysis and practical recommendations to achieve a quantifiable business impact.