Companies with specialised service offerings in governance and compliance include:

With the exponentially-growing interest in decarbonisation, many B2B carbon management services and products have also been birthed as a result of the pressure on organisations to innovate to carbon-free business models. Forecasts on the carbon footprint and management industry also reflect this, as the industry is expecting to grow by a CAGR of 6.2% from its 2020 figure of USD 9.0 billion to USD 12.2 billion by 2025.

The solutions and services in the carbon management industry range from a number of ways to assist organisations in minimising energy and waste generation, monitoring carbon output levels, reduced environmental impacts from projects, and so forth.

In order to quantify efforts made towards a net-zero carbon economy, the concept of carbon footprint as a measurement was introduced and forms a fundamental part of carbon management. Carbon footprint is calculated by the overall emissions from each stage of a product or service’s lifetime, and indicates the total greenhouse gas emissions caused by the product or service.

Naturally, the carbon footprint model is still not a universally standardised calculation, as knowledge limitations exist as to which types of emissions and gases are to be included when determining this figure. Many companies have seized this knowledge gap as an opportunity to then expand into carbon management services and products as a means to accurately calculate carbon footprint and ensure organisations are on track with sustainability goals.

A number of different carbon management product and service categories currently exist to tackle the challenges of both identifying potential areas to decrease greenhouse gas emissions and to measure their business’ impact on the surrounding environment. The carbon management industry can broadly be grouped into the following products and services.

With rising complex environmental regulations for companies to adhere to, evaluating compliance in everything from supply chain logistics to site setups can prove to be difficult. Companies such as Assent, OneTrust, and iPoint are examples of solution providers to help navigate complex market regulations related to carbon management and ensure that your company operations are fully compliant.

Carbon trading platforms are another form which permits companies to have a certain level of carbon dioxide emissions if they contribute towards other decarbonising efforts (e.g., such as investing in decarbonising efforts in developing countries). It also allows companies with remaining carbon credits to trade them for financial compensation as a means to incentivise organisations to curb their level of emissions. Examples of carbon trading platforms include Climatetrade, Carbonex, Xpansiv and Pathzero which help connect companies that are willing to offset carbon emissions to different environmental projects with an overall aim to fight climate change.

Carbon accounting companies help to measure the level of emissions from the different processes that an organisation’s product and services produces. Products that fall under this service category can include business environmental reports, national inventories and carbon footprint calculators. Companies such as Sinai, Climate Neutral, Carbon Chain, and Normative all provide carbon accounting services to help entities become carbon neutral and are now considered an industry-standard requirement.

ESG platforms help to manage and mitigate risk by assessing a company’s overall health and quality. This is done by looking at a company from three core ESG areas; environmental, social, and governance. Investors often utilise ESG platforms such as Envizi, SAP, Enablon and Sphera to assess investment decisions from the three aforementioned perspectives. As green investment trends continue to grow, studies have found that assets managed through ESG strategies grew by 42% from the beginning of 2018 to 2020.

Carbon management services and products are used throughout nearly every industry as carbon-neutral goals have been set in place as a worldwide movement. However, certain industries have seen heavier usage and investment in these services and they consist of the following sectors.

Oil and Gas

The oil and gas industry has seen heavy investment and is one of the most significant players in the market of carbon management products. This industry sees everchanging fluctuation due to the introduction of various policies and legislation to decarbonise and minimise environmental impacts. As a result, many companies have taken to using carbon management services such as Shell’s usage of carbon credits to offset production emissions, and even created their own carbon management products such as BP’s Target Neutral software that offers a number of carbon offsetting solutions.

Manufacturing

As a carbon-intensive industry responsible for one-fifth of carbon emissions, the manufacturing sector has received growing pressure to address the level of greenhouse gas emissions it produces and decarbonise. Areas of interest for carbon management products include carbon accounting as manufacturing companies often need to evaluate the carbon footprint of their entire supply chain process for their products. An example of this is how Siemens, Dow and Arçelik exchanged carbon footprint data from their components in an Arçelik washing machine to determine the overall carbon footprint.

Healthcare

The healthcare industry is also another sector which has seen steady investment into carbon management services as many healthcare companies look to achieve carbon neutral business models. This ranges from utilising carbon offsetting or trading services for operations to carbon accounting for their supply chains. Kaiser Permanente is an industry example as it became one of the first US health systems to reach carbon neutral status by investing in making its buildings energy efficient, ESG investments and buying carbon offsets.

IT and Telecom

The IT and telecom sector also keep a close eye on their carbon emissions levels that are primarily produced from their upstrean supply chain, the energy consumption of IT services, and the downstream use of electricity from consumers using the IT services. The ICT sector is currently responsible for around 3-4% of global carbon emissions and is expected increase rapidly. As a result there is a heavy usage of ESG platforms with many ICT companies scoring suppliers on compliance and require transparency on ESG criteria. Vodafone, for instance, has set new emissions targets for its suppliers and ESG scores now account for 20% of its assessment criteria.

Automotive

The automotive and transport sector has also seen recent changes from leading companies in the space to decarbonise. These efforts have been ramped up with governments worldwide pledging to cut carbon emissions and placing tighter regulations on the sectors’ operations. This sector sees a heavy focus on carbon accounting services as production of materials are largely responsible for emissions in this sector. Examples of automotive companies include industry leader BMW which has pledged to reduce carbon emissions by 40% in its product life cycle by 2030. It is expected that the automotive industry will see a significant shift towards investment in carbon management products and services to meet set goals by the end of the decade.

Energy and Power

The energy and power sector has seen rapid action and pressure from both international organisations and governments worldwide to decarbonise operations and meet climate goals set from the Paris Agreement. This sector currently accounts for the largest market share in carbon management as energy efficiency has become a universal goal for governments. Carbon trading services have seen a large amount of interest from this sector as energy and power companies look to offset their emissions. Companies such as ENGIE have even taken this a step further and produced their own carbon intelligence platform to track emissions in real-time and optimise their business decisions to follow a carbon net zero strategy.

Although governments worldwide have been carefully lifting restrictions implemented during the COVID-19 pandemic, many countries are still slowly recovering from the economic slump and this has created implications on low-carbon investments. Policymakers have been confronted with challenges as a result of trying to kickstart the economy while meeting previously agreed climate goals. This has translated into concern from different environmental activists and organisations on governments prioritising rapid economic development over long-term carbon neutrality investments. The factors that put the carbon management market at risk include:

If governments worldwide are to continue in their journeys to a net-zero economy then investment in carbon management will be inevitable for both the private and public sector. By measuring and understanding the carbon emissions impact of a company or organisation’s operations, will allow for countries to lower their carbon footprint and meet climate goals.

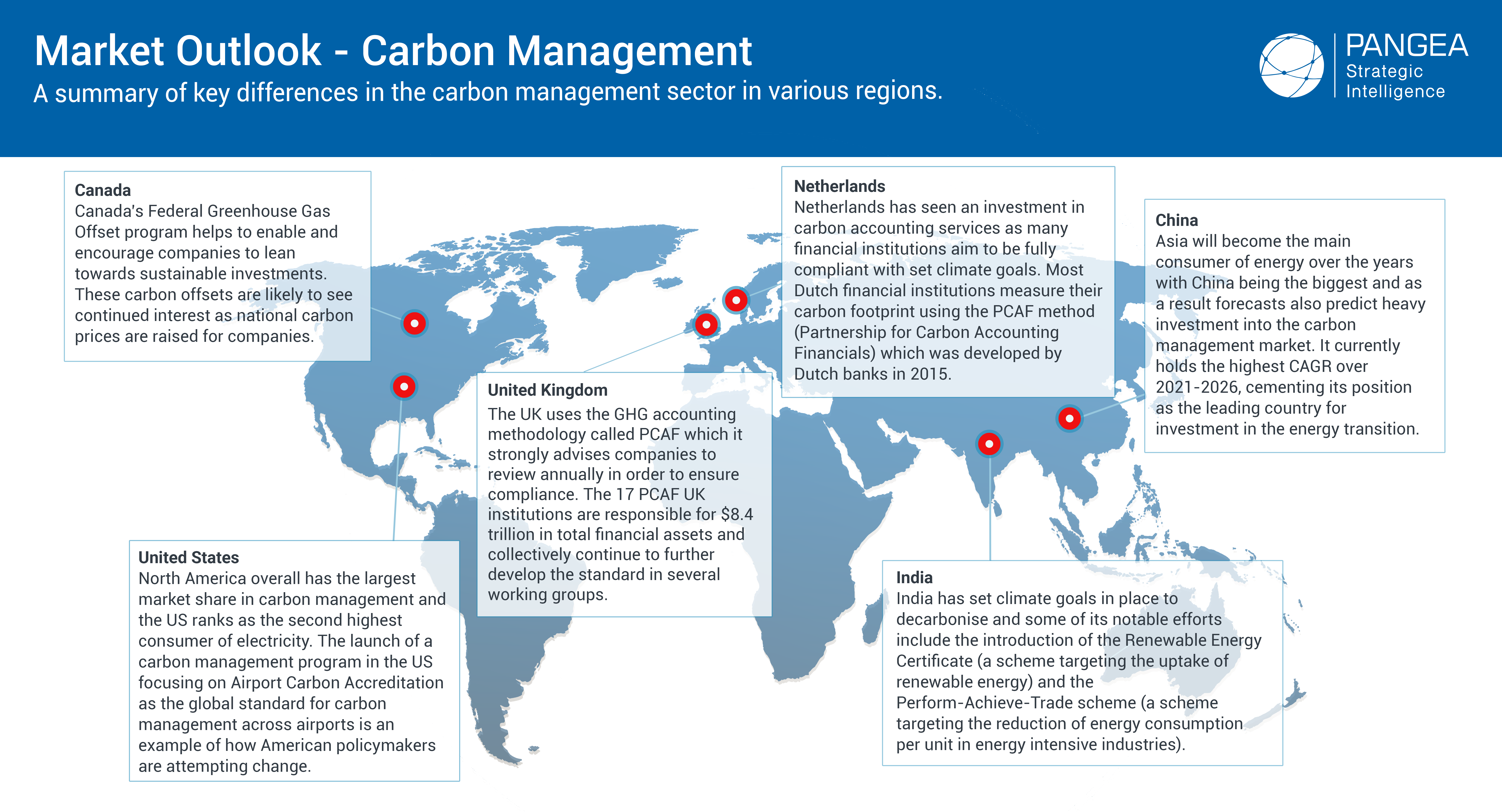

Efforts related to carbon management are occurring on a global scale:

|

United States North America overall has the largest market share in the carbon management system market as general public awareness on energy efficiency remains high and has prompted growth in carbon-neutral investments. There has also been a heavy focus in energy efficient buildings where government initiatives are boosting the market demand for carbon management services as the US currently ranks only behind China as the second-largest consumer of electricity. |

Canada Canada has launched the Low Carbon Economy Fund which helps fund up to $2 billion in projects that reduce carbon emissions, promote sustainability, and create jobs for the Canadian economy. Additionally, Canada has a set price for carbon under its Greenhouse Gas Pollution Pricing Act to drive companies towards sustainable investments. Companies can opt to purchase offsets through a carbon trading program if they exceed emission limits. |

|

China China currently has the world’s largest carbon footprint and it has pledged to go carbon neutral by 2060. The country has seen a pivot from industrial groups, energy companies and financial institutions to the carbon management market. These companies have begun to create internal systems for the measurement and reporting of greenhouse gas emissions, and developing capabilities for trading carbon credits. |

India India’s governing body has set a net zero target for greenhouse gas emissions by 2070, which is one of the later deadlines comparatively to other countries. Carbon accounting has recently seen growth as more conversations on carbon pricing have been brought up in the energy and power sector, which sees multiple challenges in cutting emissions due to poor gas resources and infrastructure. |

|

Netherlands The Netherlands actively participated in the 2019 Climate Commitment by promising to slash emissions to 49% by 2030, in comparison to 1990 levels. More than half of the 50 financial institutions in the Netherlands are monitoring the carbon footprint of their investments to align their corporate strategy to the Dutch government’s climate policies. Therefore financial institutions alongside companies across multiple sectors have heavily invested in carbon offsetting and accounting services to be compliant. |

United Kingdom The UK has also set ambitious climate goals of reducing emissions by 78% by 2035, and has introduced various decarbonisation plans as a result. The UK also follows the PCAF method (Partnership for Carbon Accounting Financials) however growing concern has been mounting over whether this is the most accurate way to measure carbon footprint. Many carbon accounting firms exist as a result, to help companies manage their PCAF reporting processes and make more sustainable decisions. |

More Confident Investment Decision Making

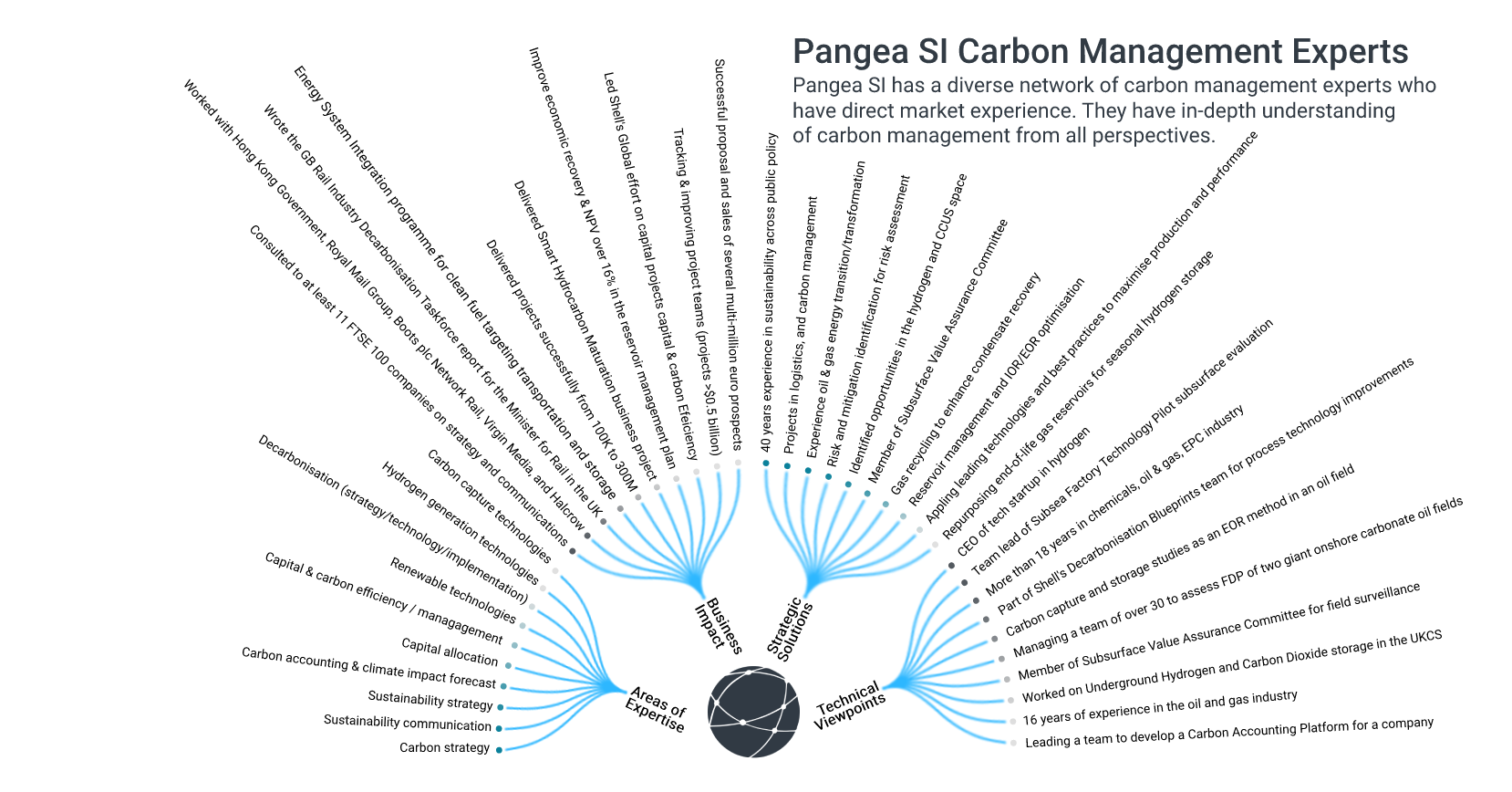

Expect to make truly informed, risk-reduced decisions. 100% of our clients believe our platform has enabled them to “increase the speed of their early-stage research into new areas.”

Insights On Demand – in as little as 48 hours

You can access subject matter experts from anywhere in the world, whenever you need them. When technical challenges or commercial projects arise which need specific results, you can obtain valuable consulting recommendations from vetted Experts.

Commercially Effective Research

Your research capacity and capabilities are augmented through Pangea SI Experts – there is no need for hefty strategy/management consultancy retainers and you can forego the process of having to hire someone full time.

1

Clients notify us that they need leading insight for their project.

2

We engage and vet subject matter Experts matched to the request at speed.

3

Clients consult with their shortlisted Expert(s) and obtain forward knowledge to incorporate into their strategic plans.

4

Clients benefit from more refined analysis and practical recommendations to achieve a quantifiable business impact.