Companies that are heavily investing in CCS technology and products include:

CCS generally involves the use of technology to capture and store carbon dioxide emissions from various sources with the overarching goal of reducing climate change. By stabilising carbon in solid and dissolved forms, the emissions then become less harmful to the environment and reduce global carbon footprints.

However, this industry faces scale-up issues caused by high costs and capital required in order to establish carbon capture plants and source advanced technology.

There are broadly three types of carbon sequestration: biological, geological, and technological, each of which can be further broken down.

Biological carbon sequestration refers to the capture and storage of carbon dioxide in grasslands, forests, oceans and soils.

Geological carbon sequestration stores carbon dioxide in geologic formations or rocks underground through its porous surfaces. The process of storing carbon requires human intervention as carbon dioxide must be captured from human activities and injected into the rocks to store for longer periods of time.

Technological carbon sequestration, on the other hand, focuses on discovery and creation of innovative technology to trap and store carbon. Other appealing alternatives of what to do with the carbon also exist, such as how it can be potentially used as a resource.

The most significant challenge for the CCS market to overcome is perhaps the towering costs involved with setting up and implementing technology to capture carbon. It has been estimated that the levalised cost of production with CCS ranges around $70-$130 per tonne in cement production. Despite these soaring costs, the overall capital involved with setting up infrastructure for CCS is, in fact, still cheaper than most alternatives (such as electrolytic hydrogen) and is an inevitable cost with the new stringent measures set up by governments to fight rising carbon emissions.

Many companies also view CCS as a short-term solution to meet set government net-zero goals rather than focussing on addressing business processes that are creating high carbon emissions. An example of this being major fossil fuel and coal-fired power generation firms relying on CCS to reduce the net level of emissions they produce. As such it is important for businesses to remember that CCS should be used adjacently and in addition to further decarbonisation efforts.

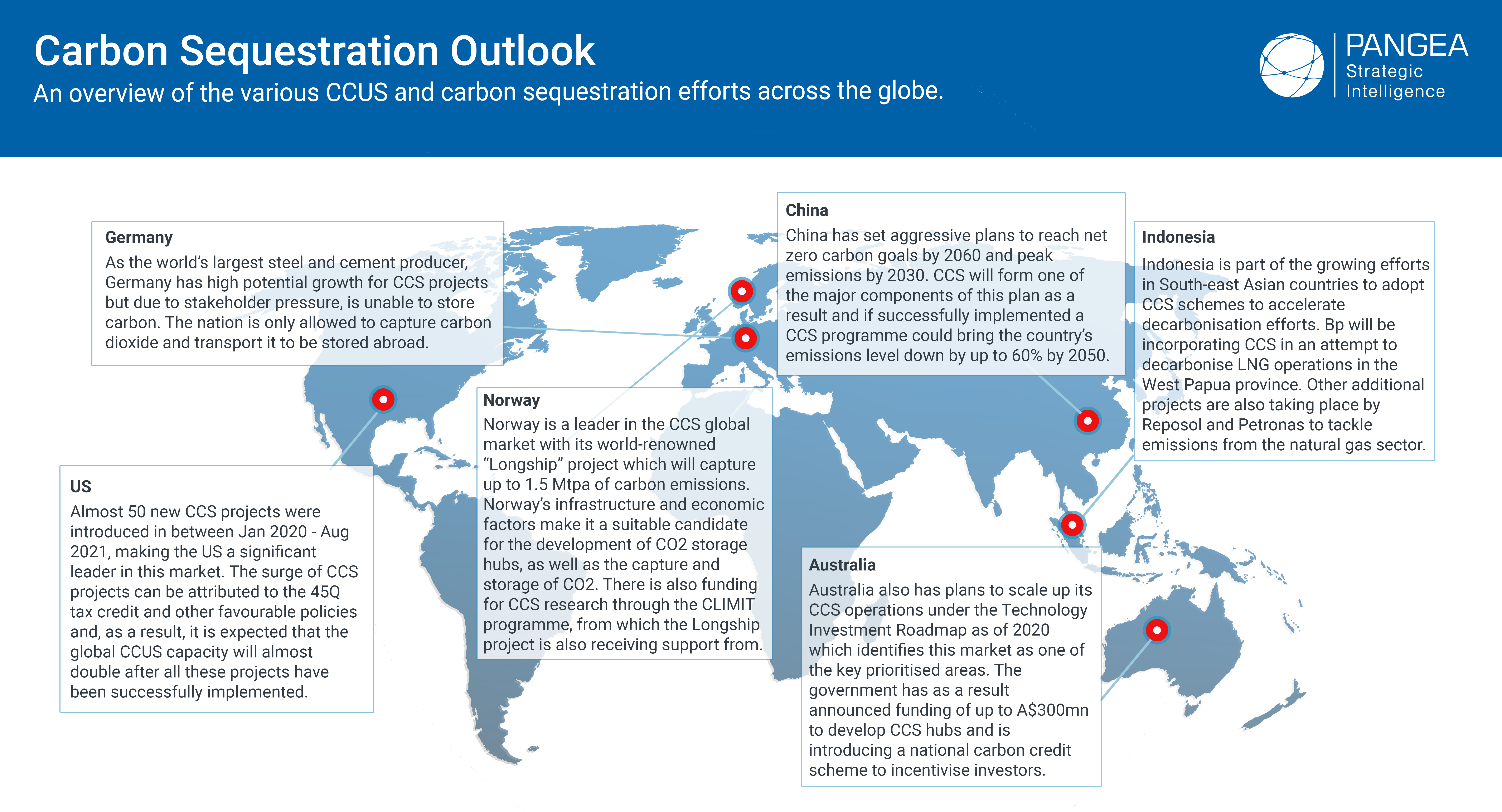

Governments and administrations will need to play a significant role in helping to develop CCS initiatives along by providing financial incentives and favourable policies for investors with an interest in projects aimed at decreasing carbon dioxide levels.

The public sector can mitigate some of the threats and risks associated with CCS by creating comprehensive guidelines for the private sector to follow and abide by. If CCS is incorporated and embedded into national plans of decarbonisation, it will likely be able to kickstart the process of becoming carbon neutral and act as a catalyst to ensure countries are on the right track. By introducing bills that recognise CCS efforts in the form of carbon credits or government subsidy programs for CCS projects, the public sector will be able to bolster the interest in these technologies to overcome the high cost barriers these firms face.

The scientific community has brought forth a number of suggestions to help CCS projects which include:

The CCS market is likely to expand to a $200 billion market as it will play an integral role for world economies in meeting carbon-neutrality agreements. The International Energy Association has stated that CCS will need to scale operations from the current 40 MtCO2 capacity (as of 2021) to reach nearly 1,150 MtCO2 by 2030. Governments will have to be careful to ensure that CCS is not abused by fossil fuel and non-renewable energy companies as a mechanism to cut corners and meet climate goals strictly speaking, rather than addressing their carbon-producing business operations. However, in the meantime, CCS technology is still a viable product to tackle carbon dioxide levels and the market will undoubtedly see a rise in popularity as it continues its key role in global decarbonisation.

Notable CCS Projects in the market include:

|

Northern Lights CCS Project (Norway) Backed by Shell, Total, and Equinor, this Norweigen project will be focused on becoming a major carbon dioxide transport and storage hub under the full-scale CCS project in Norway called "Longship". The project has seen an investment of over USD 680 million for the first phase of the project which will aim to store up to 1.5 million tonnes of CO2 for 25 years. The Longship project will utilise seabeds to store carbon dioxide by injecting it in a storage formation (saline aquifer). |

Shute Creek Gas Processing Plant (US) Known as the largest operational CCS plant in the world, this facility can store up to 7 million tonnes per year and has been in operation since 1986. The produced CO2 is captured from natural gas production and sold for enhanced oil recovery purposes to surrounding companies. However according to the IEEFA, up to 50% of CO2 that the plant has captured still gets vented back into the atmosphere due to unsold CO2 for EOR, which has raised much concern amongst the public. |

|

Petrobras Santos Basin CCS (Brazil) After a successful pilot in 2011, Petrobras was able to utilise water-alternating-gas injection technology to capture CO2 and reuse it for enhanced oil recovery. The ultra-deep waters CO2 injection project now ranks as the world’s third largest CCS project and accounts for up to 12% of global capacity. The project is continuously expanding and has overarching goals to reach 40 million tonnes of CO2 storage by 2025. |

Qatar LNG Liquefaction Project (Qatar) Qatar Petroluem’s $2.9 billion North Field East Liquefaction Project (NFE) will be the world’s largest LNG liquefaction plant and increase LNG production by approximately 50%. The project is aimed at reducing the overall carbon footprint of QFE as the nature of the project is significantly energy intensive. Investors of the LNG liquefaction project are absorbing costs and commercial risks associated with the upfront investment of CCS, demonstrating the value of the project to stakeholders. |

|

Alberta Carbon Trunk Line (Canada) The Alberta Carbon Trunk Line (ACTL) started operating in June 2020 and its primary purpose is to capture and deliver CO2 to depleted oil and gas reservoirs for enhanced oil recovery and permanent storage. A notable feature of the project is its 240 KM pipeline which is the world’s largest capacity pipeline for transporting CO2 from human activity. The plant can capture up to 14.6 million tonnes of CO2 per year making it the 7th largest scale CCS project. |

Gorgon CO2 Injection (Australia) This carbon dioxide injection project by Chevron remains one of the biggest natural gas projects in the world and averages a total daily production of 2.1 billion cubic feet of natural gas. The facility has 3 processing units in its LNG facility which can produce up to 15.6 million metric tonnes of LNG annually with a production lifespan of up to 40+ years. However reports show that the Gorgon CCS project failed to meet set expectations and operated at only a little over half of its actual capacity in 2021’s financial year. |

✓ What carbon sequestration methods are appropriate for my company?

✓ Which CCS technology is economically viable for my company to expand into?

✓ How can CCS processes help my company meet our set climate goals?

✓ Which CCS technology is showing positive signs for investors?

More Confident Investment Decision Making

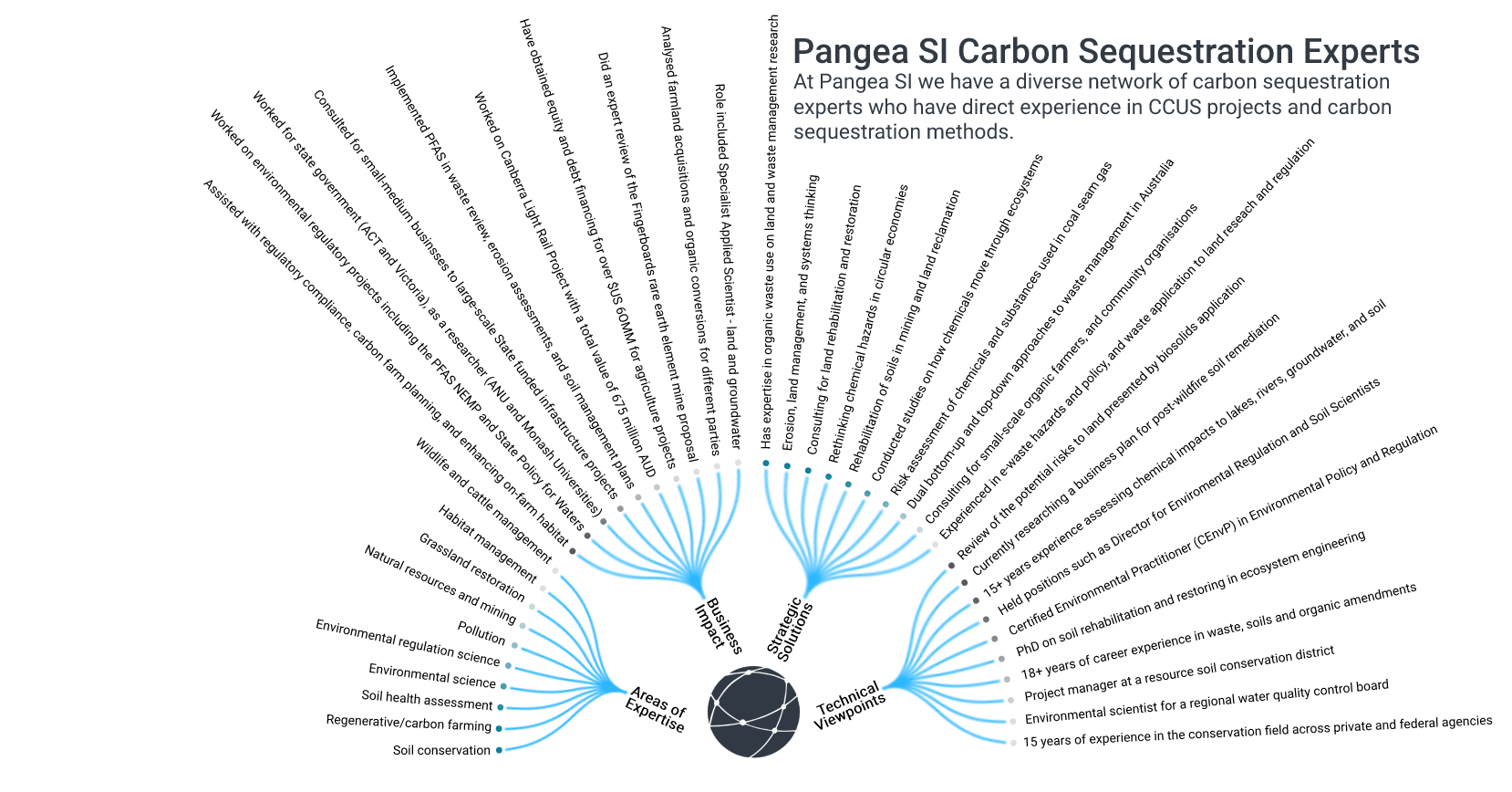

Expect to make truly informed, risk-reduced decisions. 100% of our clients believe our platform has enabled them to “increase the speed of their early-stage research into new areas.”

Insights On Demand – in as little as 48 hours

You can access subject matter experts from anywhere in the world, whenever you need them. When technical challenges or commercial projects arise which need specific results, you can obtain valuable consulting recommendations from vetted Experts.

Commercially Effective Research

Your research capacity and capabilities are augmented through Pangea SI Experts – there is no need for hefty strategy/management consultancy retainers and you can forego the process of having to hire someone full time.

1

Clients notify us that they need leading insight for their project.

2

We engage and vet subject matter Experts matched to the request at speed.

3

Clients consult with their shortlisted Expert(s) and obtain forward knowledge to incorporate into their strategic plans.

4

Clients benefit from more refined analysis and practical recommendations to achieve a quantifiable business impact.