The following hydropower companies are responsible for generating the world’s supply of hydroelectricity.

With its ability to generate low-carbon electricity on a significant global scale, hydropower currently ranks as the third-highest electricity-generating source after coal and natural gas.

The installed capacity of hydropower rose to 1330 GW as of 2020 and is expected to grow at a CAGR of 1.93% to 1520 GW by 2027.

As the potential of the hydropower market continues to grow, emerging technological trends in hydroelectricity generation are expected to see a major increase in investment over the coming years.

Hydropower’s contribution to electricity generation stands at over 55% more than other renewables combined. Its growth has been largely driven by developing countries which have received investment through government funding to scale up projects to large scale operational hydropower plants.

This renewable energy source remains essential to meeting the electricity demand for up to 28 developing countries and has proved to be scalable and cost-effective. Hydropower plants are able to also match fluctuating demand levels as their operational flexibility means they can be just as easily stopped and restarted.

With much unleashed potential, one could argue that the scaling of hydropower could solve a number of current issues related to renewable energy production and help create better energy security for economies across the globe.

A common misconception is that hydropower facilities require a dam, whereas in reality, dams are not essential to the production of this renewable energy source.

Three primary types of hydropower plants exist, each of which has its own benefits and utilises different site and facility designs.

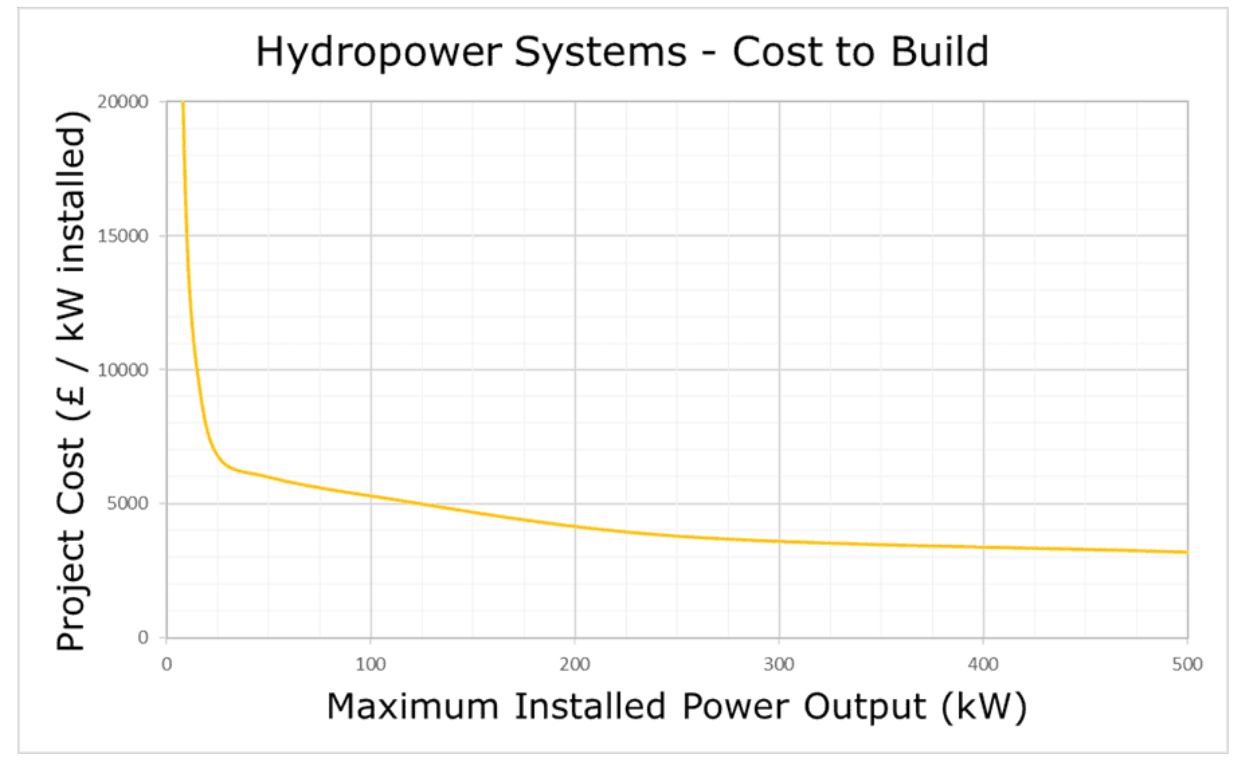

To see the full picture of how investment is impacted by the £/kW figure to its maximum installed power output, the chart below helps to explain the relationship between these two variables.

Source: Renewables First

As illustrated above, smaller hydropower systems of around 25 – 50 kW are economically disadvantaged based on the ratio of the financial costs involved. However other qualitative factors should also be considered and valued in this case as sites which are capable of large-scale hydropower production usually pose a threat to environmental, sustainable, or social concerns. Therefore smaller sites will likely encounter less red tape and shorter approval times during the initial planning and construction phases of a hydropower plant.

To ensure that governments worldwide are capitalising on the true potential of hydropower dams, it will remain essential for stakeholders involved to focus efforts on developing the industry.

As proven in many of the developing countries currently scaling hydropower operations, public policy and government funding are essential to attracting more interest from investors in this renewable energy source.

Hydropower will become one of the key players as world economies begin to look for better energy security and transition to cleaner energy sources. It is expected that developing economies will become the driving factors behind the growth of hydropower projects as it remains an attractive option to meet the rising energy demands growing in parallel to the total population count. Particularly in Asia, Africa and Latin America, lies untapped potential with many geographic regions creating ideal locations for hydropower sites to be set up.

Although initial startup costs may be high, modern large-scale hydropower plants will remain an economically-viable option for developing economies due to the long term benefits it can provide in comparison to its less sustainable counterparts. Governments and policymakers worldwide will need to prioritise passing legislation and policies that make the towering barriers surrounding hydropower, less intimidating to the private sector in order to attract the investment needed. By actioning favourable policies around this sector and reflecting the value of producing low-carbon electricity through economic and financial incentives, hydropower will be able to showcase its true potential and become a leading source of electricity globally.

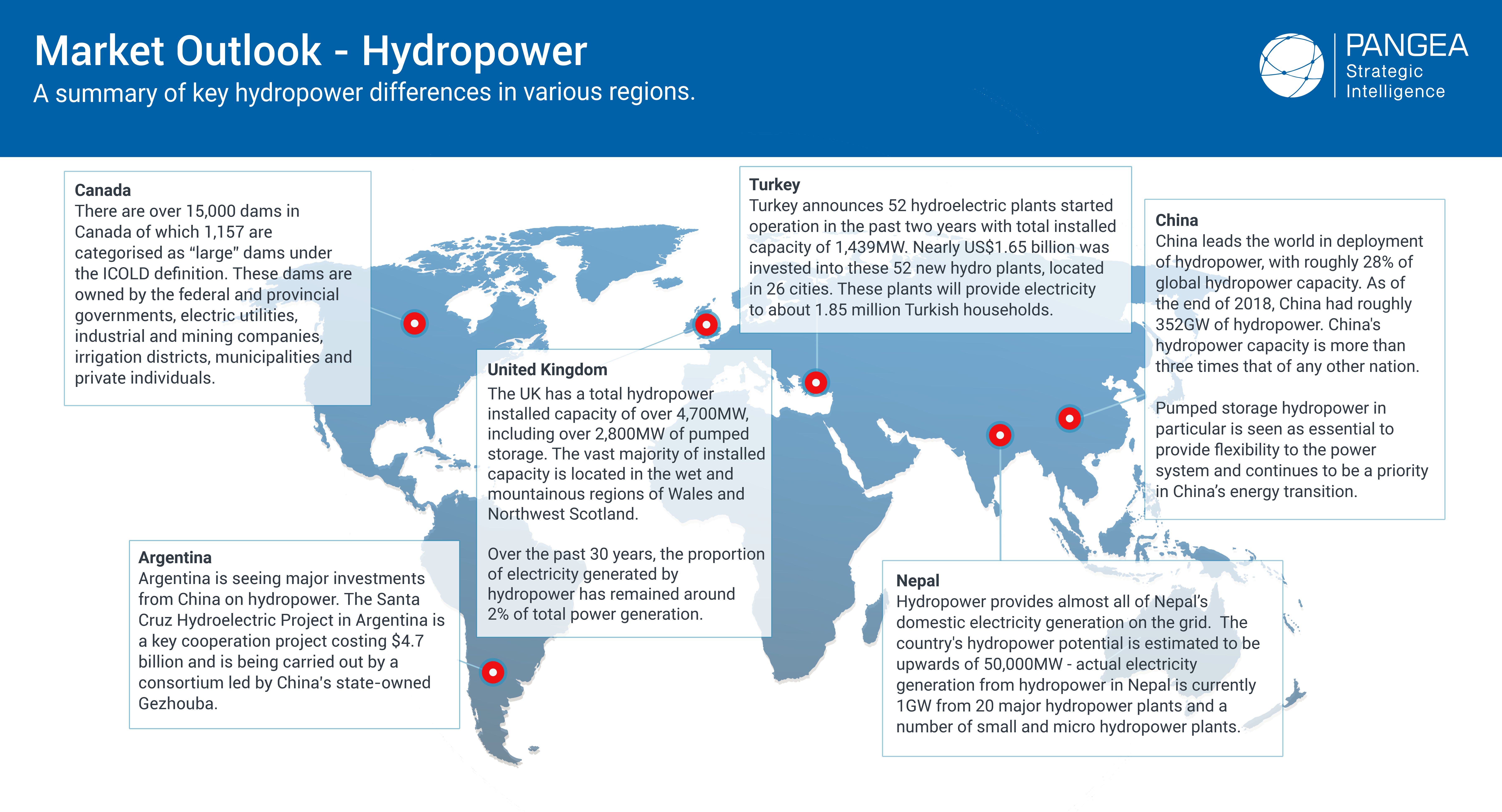

The following countries are playing considerable roles in the growth of the hydropower sector:

|

India India recently moved up the ranks, taking Japan’s spot, as the fifth largest hydropower producer with over 100 plants averaging above 25 MW each. As the population levels continue to grow, hydropower remains an economically viable option for this country to meet rising household electricity demand. However, this sector has begun to also see slower growth rates with multiple projects being delayed due to lengthy approval procedures. To promote growth in this sector again, The Central Electricity Authority (CEA) and Ministry of Power have passed a number of favourable hydropower policies. |

Turkey Ongoing hydropower developments will soon place this country in the lead for Europe’s largest expansion in energy capacity over the next few years. From 2018-2020, this country saw 52 hydro projects with a total installed capacity of 1,439 MW begin operating, and it is only looking to increase further. Turkey’s Energy and Natural Resources Ministry estimates that Turkey holds a potential of up to 433 billion kWh, making it an attractive area for investors. This is also due to its geographical advantages such as being situated between Asia and Europe and containing over 25 river basins. |

|

Canada Canada has the fourth-largest hydropower fleet coming behind China, Brazil and the United States. Over 60% of Canada’s national electricity supply is from hydropower making it an exemplary leader in clean energy production. It is estimated that the hydropower sector currently contributes ~$35 billion to Canada’s GDP (2013) and has created over 130,000 jobs across the country. Hydropower has also been the backbone of energy supplies for decades in Canada and still has the potential to grow even more. Currently Canada and the US have established electricity export partnerships and agreements in order to benefit the two economies. |

Argentina Hydroelectric power accounts for up to 60% of Argentina’s electricity-generating capabilities. With a feasible hydropower production potential of 130,000 GWh/year, it has been estimated that only 25% of its capabilities have been currently capitalised on. New projects such as the Nestor Kirchner and Jorge Cepernic dams have made headline news as these joint Argentinian-Chinese partnerships are expected to meet the daily electricity consumption demands of up to 1.5 million households in Argentina. These projects are expected to drastically reduce the country’s reliance on oil and gas import expenses. |

|

Laos Nicknamed the ‘Battery of Southeast Asia’, Laos is one of the few countries in the region propelling the movement in hydropower energy through an influx of investment in both hydropower site projects and electricity export opportunities. This is because geographically Laos has strong hydropower potential of up to 27,000 MW with the Mekong river flowing through it. The country plans to export up to 14,600 MW to neighbouring countries by 2025 as it continues to ramp up hydropower projects and the grids for electricity conversion. A majority of these hydropower projects are financed or partnered alongside Chinese firms, and this country currently remains one of the largest beneficiaries from China’s financial aid. |

China China is predicted to remain the single largest source of hydropower up until 2030, responsible for 40% of global supply. However in recent years, due to the lack of space and environmentally viable sites, the hydropower industry has since slowed amid more stringent environmental policies being introduced. It remains entirely possible that other countries may take up the leading hydropower spot in the coming decades. China, however, has continued to remain one of the biggest funding sources of hydropower projects. By 2030, over half of the upcoming hydropower projects in sub-Saharan Africa, Southeast Asia and Latin America will see some form of partnership or receive financial aid from China. |

✓ What are the pros and cons of choosing small-scale versus large-scale hydropower plants?

✓ What initial costs are encountered during the first stages of constructing a hydropower plant?

✓ What geographic and political factors should be considered when choosing the location for a hydropower plant?

✓ Will hydropower plants generate significant return on investments with such high initial costs?

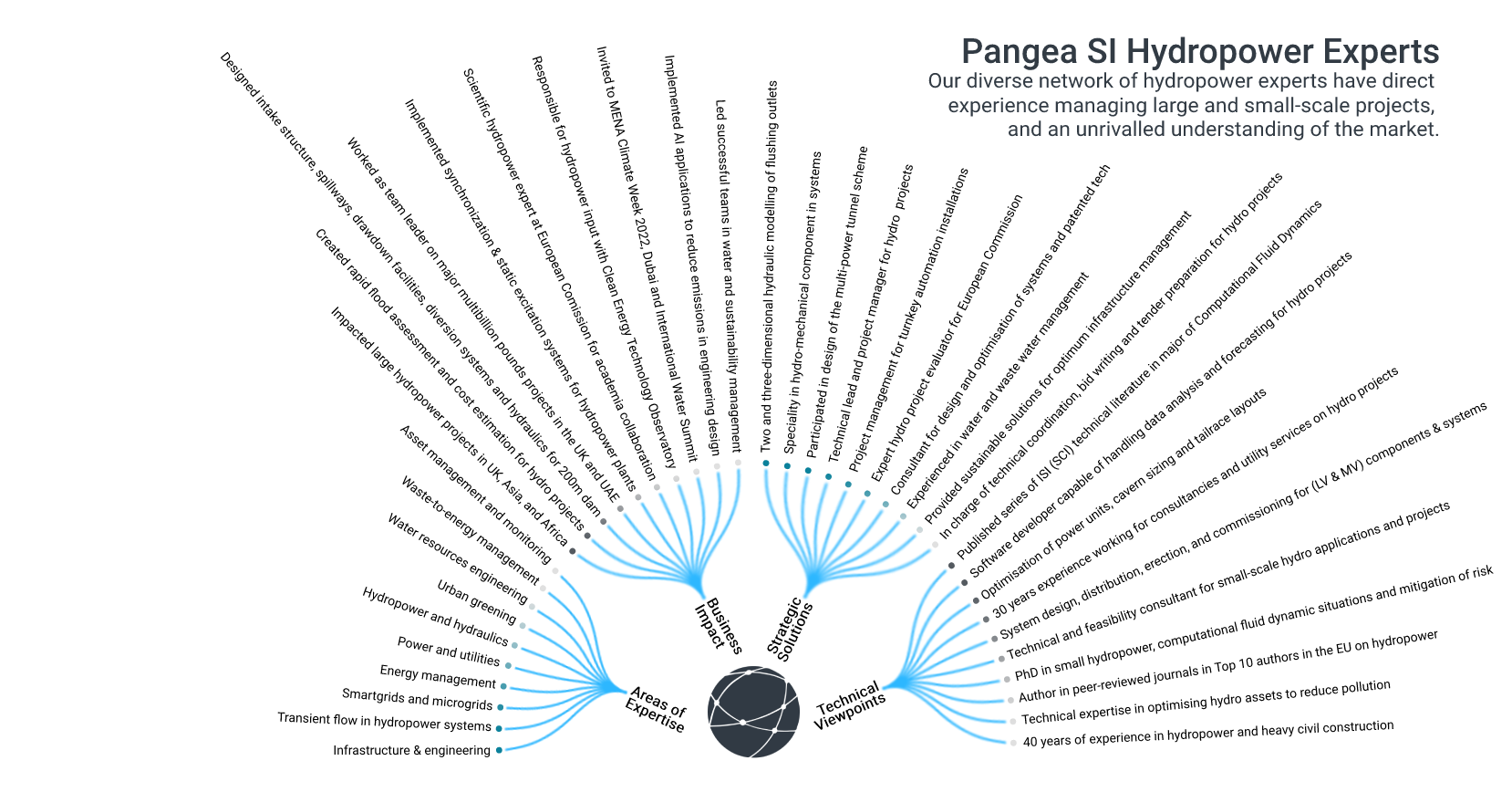

More Confident Investment Decision Making

Expect to make truly informed, risk-reduced decisions. 100% of our clients believe our platform has enabled them to “increase the speed of their early-stage research into new areas.”

Insights On Demand – in as little as 48 hours

You can access subject matter experts from anywhere in the world, whenever you need them. When technical challenges or commercial projects arise which need specific results, you can obtain valuable consulting recommendations from vetted Experts.

Commercially Effective Research

Your research capacity and capabilities are augmented through Pangea SI Experts – there is no need for hefty strategy/management consultancy retainers and you can forego the process of having to hire someone full time.

1

Clients notify us that they need leading insight for their project.

2

We engage and vet subject matter Experts matched to the request at speed.

3

Clients consult with their shortlisted Expert(s) and obtain forward knowledge to incorporate into their strategic plans.

4

Clients benefit from more refined analysis and practical recommendations to achieve a quantifiable business impact.