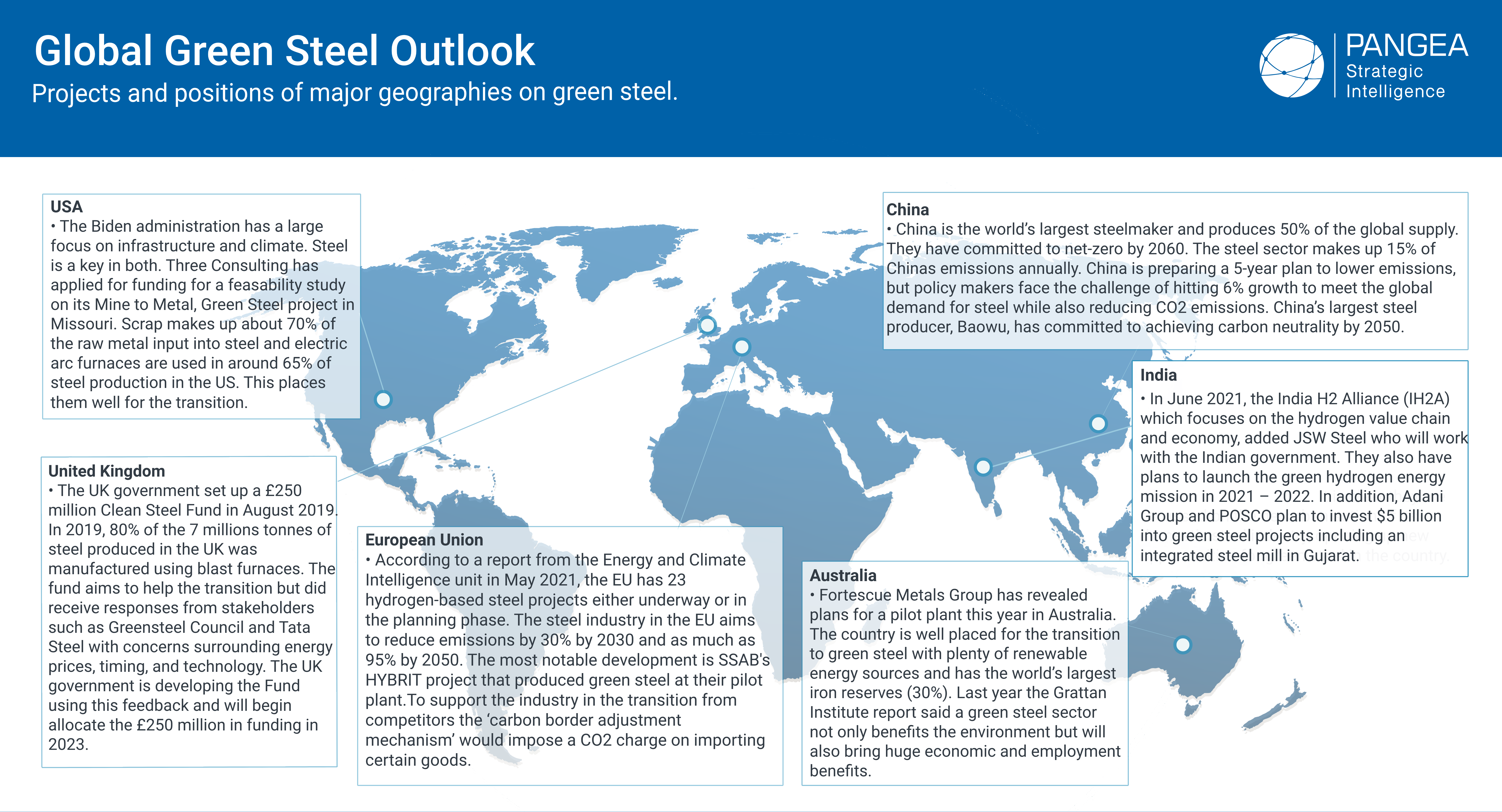

The largest steel producing nations:

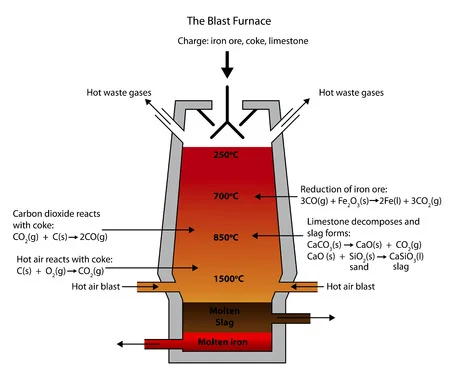

Most steel is manufactured using blast furnace technology where temperatures of 2,000°C are reached to produce molten iron. This process requires vast amounts of energy and is one of the largest CO2 producers on the planet.

Currently, a leading alternative technology for producing steel is replacing coking coal with hydrogen. The use of hydrogen instead of coking coal produces water as a by-product instead of CO2. This reduces the CO2 emissions of the production process and if the hydrogen is produced using renewable energy (green hydrogen) the whole production chain is net-zero.

The other alternative is called molten oxide electrolysis (MOE). This production process removes blast furnaces and coking ovens from the process completely. Iron ore is dissolved in a liquid electrolyte solution at around 1,600ºC. An electrical current is then passed through the solution. This causes an endothermic reaction and reduces the iron ore into a liquid. Boston Metal CEO and Chairman, Tadeu Carneiro believes that they can transform the industry using MOE. It is a green technology with oxygen as a by-product and Carneiro believes the ‘intrinsic value and flexibility’ makes it the future.

Committing to 1.5°C pathway and emerging technology

For the industry to achieve the 2050 net-zero goal, emissions must be reduced by a minimum of 30% by 2030. To do this, the production process must change. Innovation is taking place and new technologies are being developed. Natural gas and hydrogen are being used for the direct reduction of iron ore (DRI-EAF) and an effort is being made to improve the recycling of steel.

In mid-2020, SSAB, a Swedish steelmaker, made a huge breakthrough for green steel through their joint venture with Vattenfall and LKAB, which aims to establish a demonstration plant at scale in 2026. Steel production using HYBRIT (Hydrogen Breakthrough Ironmaking Technology) will result in clean-burning gas during the carbon purification process and for the manufacturing of iron pellets. The result of using a renewable energy source such as hydrogen is steel that is manufactured with no CO2 emitted.

Reducing the CO2 emissions of current steel production methods is not a simple task. Recycling metals seems like the obvious route – over 20% of globally produced steel was made by remelting scrap with electric arc furnaces (EAF). But recycled steel is a lower quality metal and can have contamination issues meaning it is not a direct substitute for virgin steel at present. Many of the major steel producers are also increasing their usage of scrap metal to gain value from end-of-life by-products however this brings to light additional considerations related to non-coking coal processes and ESG regulations.

The deployment of low-carbon steelmaking technologies on a commercial scale is critical. As the world transitions, renewable energy options are becoming more cost-competitive, carbon emissions regulations are constantly evolving, and new, more innovative technologies are being developed for only 20-30% higher in cost. As low-carbon processes are becoming economically viable, the green steel industry is set to benefit. Once coking coal and coke markets hold less importance to industry operators and regulators, we could see green steel prices hike up drastically whilst the perceived value of globally accessible green products command pricing premiums.

As a planet, we require the production of approximately 1.7 billion tonnes of steel a year. This is only going to grow – expected to be as high as 2.2 billion tonnes by 2050. Over the past 30 years, the steel industry has made significant strides to reduce its energy consumption by around 50% according to the World Steel Association. To make further progress, the adoption and acceptance of new technology is a necessity. However, the scale of change to the steel industry that is required is colossal.

It is broadly accepted that a regional steel industry is an engine of downstream innovation and economic growth through the engineering, manufacturing, and production sectors. According to the World Steel Institute, each job created in the steel industry indirectly leads to an additional 8 jobs. As industry activity increases so will the importance of local labour markets.

Although green steel is highly important for the planet, new technology is required to make green steel commercially viable. The first reason why decarbonising the steel industry is a major challenge is that green steel is a premium product. The steel industry simply put, combines two commodities — coking coal and iron ore. As coking coal is replaced for hydrogen it means iron-rich locations are ideal. Therefore, countries like Australia are looking into the opportunity of establishing themselves as a global steel export superpower, like what China achieved in the early 2000s.

The adoption of new technology

The opportunity for green steel depends on multiple cost-reduction pathways: renewable energy, hydrogen, and electrolysers, still in the early stages of cost reduction. The main drag for the industry is the level of new steelmaking technology being commercially implemented and rolled out.

Change in electricity prices

Among many obstacles, the required investment is huge – it could run into hundreds of billions of dollars. In an industry that has volatile profitability, this is difficult to fund. The shift to electricity from hydrogen changes the cost completely as the focus is on a different energy market. Both hydrogen direct reduction and molten oxygen electrolysis use electricity as the main input. Electricity prices of $15–$30/MWh, which is a cost not too far from most renewable power sources currently available in the range we require.

The price of steel fluctuates but roughly speaking is $550 per tonne. Early investment assessments predict that full-scale hydrogen-based steel production would correspond to a 20%– 30% higher cost compared with conventional steel production. Many of the costs in the production process are similar for green and traditional steel such as labour and iron costs. But the use of different energy markets is what causes the rise in price.

The electricity prices required to have green steel equal price to traditional steel is not too far away. Regionally, research showed that the average wind power price in the central United States has dropped below $20/MWh. Solar PV is reaching these cost levels in some parts of the world as well, with record power purchase agreements cleared below $20/MWh in the Middle East, Mexico, Brazil, Portugal and Los Angeles. With the costs of renewables falling fast, hydrogen will also begin to fall making a more competitive steel landscape and making green steel more economically viable.

Some of a notable private investments made into green steel.

|

SSAB, LKAB and Vattenfall - The joint initiative has commenced building a rock cavern storage facility for hydrogen gas on a pilot-scale next to HYBRIT's pilot facility in Sweden. It is important that a fossil-free value chain is developed for green steel. The investment cost around SEK 250 million and is divided equally across the holding companies and the Swedish Energy Agency. |

EIT InnoEnergy and other strategic investors - These companies have helped H2 Green Steel raise $105 million in its first round of venture capital financing. The Swedish group aims to start production just below the Arctic Circle in 2024 and plans to produce five million tonnes of emission-free steel by the end of the decade by using hydrogen produced with renewable energy to make the alloy rather than the traditional way. |

|

Rio Tinto - They have teamed up with Paul Wurth and SHS-Stahl-Holding-Saar on low-carbon iron in Canada. The collaboration will look to explore transforming iron ore pellets into low-carbon hot briquetted iron (HBI), a low-carbon steel feedstock, using green hydrogen generated from hydroelectricity in Canada. All in an economically viable way. |

ArcelorMittal - They launched XCarb™, designed to bring together all of their reduced, low and zero-carbon products and steelmaking activities, as well as wider initiatives and green innovation projects, into a single effort focused on achieving demonstrable progress towards carbon-neutral steel. |

|

Vale - Vale invested $6 million in Boston Metal, a start-up developing steel decarbonisation technologies. They are mainly focused on a Molten Oxide Electrolysis (MOE) technology. Vale, Kobe Steel and Mitsui & Co agree to combine green ironmaking solutions. The new venture will use existing and new low-CO2 iron-making technology such as Tecnored® technology and the MIDREX® Process. |

BHP - BHP is reportedly prepared to invest up to $15 million over the five-year partnership with JFE to develop low-carbon steel. BHP backs Boston Metal in a Series B funding round. BHP Ventures is the internal venture capital unit within BHP, which is seeking to solve critical global challenges through its investments |

✓ What are the challenges that green steel is facing which may impact my business?

✓ Why is the production of green steel important in the context of reducing CO2 emissions?

✓ What are the main barriers to reducing CO2 emissions in the steel industry?

✓ What are the latest technological and furnace developments in the industry?

1

Clients notify us that they need leading insight for their project.

2

We engage and vet subject matter Experts matched to the request at speed.

3

Clients consult with their shortlisted Expert(s) and obtain forward knowledge to incorporate into their strategic plans.

4

Clients benefit from more refined analysis and practical recommendations to achieve a quantifiable business impact.