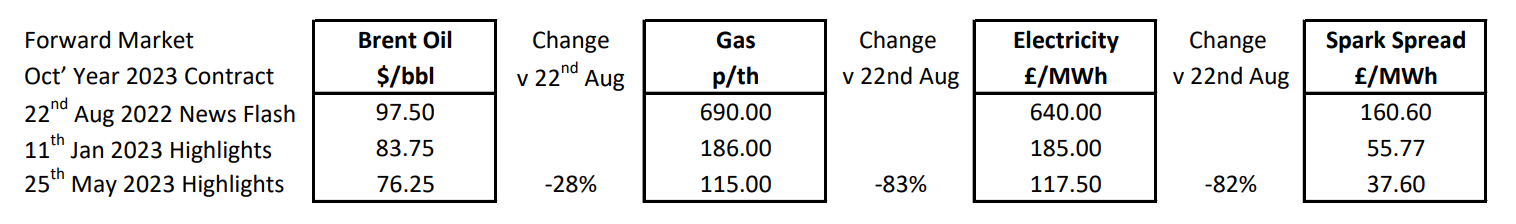

Forward gas and electricity prices hit record highs last August, just as the October Year buying window was drawing to a close. Annual contracts for both commodities fell sharply falling by over 80% in the subsequent 8 months.

Oil markets also declined since, down over 30% at one stage although crude prices have recovered in recent weeks with prices weighed down amid fears of a worsening global economic outlook and a (possibly transitory) surplus of embargoed petroleum products from Russia hanging over markets across Southeast Asia.

Recent developments include last month’s 1.0 million barrel per day product cut of Saudi Arabia, a 0.5 mbd reduction promised by Russia and further pledges by other OPEC+ producers, increasing the total headline reduction since OPEC’s October 2022 meeting above 3.5 mbd. So far, the pledges have had only a modest effect on prices, but should the market see evidence of the cuts being delivered or possibly enhanced further then we should see this translate into higher oil prices from that point on.

The medium-term picture in many such oil-producing countries remains unsettled, notably Sudan, Iran, Iraq and Syria. North African and Middle Eastern producers have been experiencing the world’s highest population growth for some years now which will ultimately limit future oil production available for export. As also discussed in past editions of Energy Highlights, the output cuts pledged above may be irrelevant anyway with many oil producers struggling to fulfil their existing quota as they stand. If that is still so, the forward supply could turn out to be tighter than the headline statistics indicate.

A key consideration for OPEC ministers will be the recent decline in the US dollar. This automatically reduces the income of exporting countries, and the problem will weigh on decision-making over the coming months. At this point, it is useful to take a step back and recall the founding principles of OPEC since it was established in 1960. Leaving “oil weapon” rhetoric to one side and with it the 1973 ‘oil embargo’ (which finally affected just two refineries, Rotterdam and Genoa, sparing the rest of Europe and the USA completely), the cartel’s founding objective was to “stabilise the export revenues of Arab oil-producing member states”, i.e., to maintain export incomes, not to seek higher short-term prices per se. However, the weaker Petro-dollar, rampant inflation worldwide and sharply increasing spending commitments at home look certain to be viewed as a threat to the same revenues which OPEC ministers are charged with protecting, via output cuts if necessary. Therefore, May’s production cuts should not have come as a surprise, nor should future ones Adding to the mix will be the influence of ‘OPEC+ hawks’ including Russia and Iran who have a heightened incentive to see inflation rates in NATO economies bubble further. Before moving the discussion to gas, it is a sobering fact that over 70% of the world’s proven gas reserves remain in the hands of only two energy companies, Gazprom, and National Iranian Oil Corporation.

Going to wire, crude prices have started creeping up slightly but Dated Brent is still trading 25% below the energy peaks of last August and still 50% below its $140/bbl peak reached in May 2008, or 70% below in Petro-dollar purchasing power terms – precisely the policy metric which OPEC oil ministers will be focussing on under their 1960 remit.

Unfolding events in oil markets are likely to have implications for industrial & commercial gas buyers as well. Notwithstanding the fall in North Sea production, Europe generally is set to become ever more dependent on international LNG, a market which exhibits a closer correlation to oil prices than the auction & forward trading markets which had predominated up until the invasion of Ukraine. This transition is speeding along with Italy set to join Germany next month, set to complete its own new offshore LNG reception facility, ready to import gas in time for next winter.

This year to date, UK power prices have shadowed gas downwards, falling nearly 40% in 4 months from £185.00/MWh to £133.00/MWh. The available capacity concern was alleviated amid warmer weather across Europe, with nuclear & thermal base-load generation and spinning-reserve gas & coal output together proving sufficient to always cover demand. Although this was a fortunate outcome perhaps, assisted by a significantly warmer-than-average European winter, a slower-than-expected recovery in energy demand in China and – if only temporarily – cheap Russian gas and petroleum product supplies finding their way into parts of Europe as well as Asian markets.

French nuclear electricity is perhaps the single most critical factor in the equation looking ahead. Its 56 1970s-design nuclear power stations now have an average age of 39 and everyone is now operating at or beyond its original design life. The national plan in progress now is simply to prolong their lives for as long as possible – a ‘play for time’ if you like. No new-build French plants are expected until 2030 – 2035. This sticking-plaster approach is contentious, however. Even to the layman, it has an ‘air of experiment’ about it. And since the reactors share the same design, a significant future safety system or a component failure in any one of the extended-life reactors could well see other units taken offline to be re-inspected or potentially shut completely as a precaution.

EDF has certainly made substantial progress in resuscitating its fleet. But the technology or safety risk is a significant one. Adding to the many other uncertainties that the European power market will have to contend with over the next 24 months, notably in respect of increasing reliance on international interconnectors and renewable generation, which can each be unreliable. By the year 2025, 50% of Installed UK generation capacity will be renewable (31 Giga Watts’ capacity) whilst seven inter-connectors (four of them from France direct) will provide the UK system with a further 11 GW (just under 9% of Installed UK capacity). Of course, like renewable electricity itself, the presence of an interconnecting cable is no warranty of supply itself. Consequently, the power market is set to rely on more intermittent generation generally as well as conditions in overseas oil, gas and electricity markets. This may help explain the exponential rise in network balancing costs, including the Balancing Services Use of System (BSUoS) charge which was a historically residual quotient in bills but has risen in three years from barely 0.25 p/kWh to circa 3.75 p/kWh now and this balancing surcharge is still climbing. The relative loss of base-load capacity in the system generally will also increase the risk-premium in forward power contracts posted out on the curve, inevitably adding pressure to end-user prices.

There is no such thing as a ‘non-volatile market’ in energy. But out of the three commodities, it is electricity which should probably illicit the most concern. For whereas oil and gas supplies can – under the existing price mechanism – be mobilised short-term to balance the market, each with the benefit of storage on top, the same degree of assurance cannot be extended to the power market.