After months during which Russia steadily reduced its gas supply to Europe, it finally announced the closure of the Nord Stream 1 pipeline in Sept 2022 and linked the resumption of supplies to the lifting of sanctions on Russia.

The key questions for European governments are:

This document addresses the first question and part of the second one – can Europe survive without Russian gas, and what should governments do? First, the total volume of possible additional alternative gas supply will be analysed, with a conclusion that this cannot fully compensate for Russian gas. Next, the volume of gas demand savings Europe must make will be presented. This volume will be compared to the demand reduction already observed in 2022, including analysis of recently available Q3 data, and what might be reasonably expected in future.

So far, most published analysis has focussed on the immediate problem of whether Europe can survive the coming winter without supply disruptions. With European gas storage reaching healthy levels, this now looks increasingly likely. However, the real challenge starts next year, when Europe will need to rebuild stocks for future winters without being able to count on a supplier that used to provide 40% of its gas. Therefore, this document will focus on restoring balance in the European gas market over the mid-term – the next one to three years.

Although the UK received very little gas from Russia, it is intimately exposed to Europe’s problem through higher energy prices, competition for LNG supply and its need for pipeline gas supply from Europe in cold winters. Europe’s problem is also the UK’s problem. In this document, references to “Europe” include the UK, unless stated otherwise.

From 2010-2019, Russian gas exports to Europe increased as the Netherlands phased out production from the huge Groningen field following issues with local earthquakes. In 2019, the Russian supply reached 181bcm or around 40% of the total supply. It dropped over 2020 as demand collapsed due to Covid, but failed to recover in 2021, with Russia supplying only 139bcm. Supply decreased further in 2022 with the outbreak of war in Ukraine, as Russia began to see gas as an economic weapon against European sanctions.

In September Gazprom stopped flows entirely through the Nord Stream 1 pipeline. Gas continues to flow from Russia through two other main routes – Ukraine (at a greatly reduced rate) and through the newly built TurkStream pipeline. Russia will probably continue to supply some gas volumes to the few remaining European states it seeks to maintain friendly relations with – especially Hungary. This residual volume is estimated at 10bcm based on the gas volumes still being flowed.

Taking the above into account, relative to 2021, Europe needs to replace around 130 bcm of Russian gas with alternative sources or reduced gas demand. This is a huge volume of gas, equivalent to 23% of European (EU27+UK) 2021 demand. Some help is provided by the gas held in storage in Europe, but this buffer can reasonably be relied on for only the coming winter. After that, Europe will need to have found a combination of demand responses and alternative supply sources to fully replace this volume. The stakes are high. If Europe fails, it risks ruinous shortages with gas and power rationing. If it succeeds, it deals a humiliating blow to Russia, which will lose a major revenue source.

Despite the size of the challenge, SGI analysis suggests that it is possible – provided that European governments act decisively to stimulate alternative supply and conserve energy. Supply and demand responses to the crisis are analysed in the following sections.

Europe derives its gas supply from Russia, domestic production, LNG imports, Norway, North Africa and Azerbaijan. SGI’s estimate of the extra volumes available from each of these sources is shown in table below1. By far the most significant source of extra volume, but also the most uncertain and complex, is LNG, which is discussed in detail.

| Source | Supply in 2021, bcm | Possible Additional Supply, bcmpa | Comments |

| Domestic Production | 84 | -5 | Production had been slowly declining as fields matured and some governments discouraged new investment. It will take time to turn this around. Compared to 2021, Groningen production will be 5bcm lower. |

| Norway (pipeline) | 113 | 5 | Announced by EU Commission and Norway (excludes LNG) |

| North Africa | 34 | 0 | 2021 production was already a big increase on previous years; unlikely that Algeria has the potential to produce more. |

| Azerbaijan | 7 | 8 | Announced an increase in supply to 15bcm pa in early 2022. |

| LNG | 94 | 50 | Discussed in detail below |

| Total | ~ 60 bcm |

1 Source: SGI Analysis

** Data from Eurostat, ENTSOG

LNG is a global market, in which producers in the US, Middle East, West Africa and Southeast Asia/Australia supply customers in South Asia, East Asia, Latin America, the Middle East and Europe. Most LNG sales are on long-term contracts between producers and large (mostly Asian) utilities, but in recent years a significant spot market has arisen, whose volumes are routed to whichever country is able to pay the highest price. Historically, Asian and other non-European customers could offer suppliers better prices for spot volumes than those available on the European gas markets, and most spot volumes went to Asia. Growth in Asia – in particular South Asia and China – drove growth in LNG supply. This traditional market structure changed when Covid-related demand reductions in Asia coincided with a wave of new LNG investment in 2020 and large volumes of unsold LNG were routed to Europe. In early 2021, growth returned to Asia and pulled some volumes out of Europe, but at the end of 2021 and 2022, prices in Europe finally rose to a level at which Europe outcompeted Asia. Demand growth in South and Southeast Asia stalled, whilst Chinese LNG imports declined for only the second time in history. The significant drop in Chinese demand is a function of both LNG prices but also reduced Chinese economic activity, so may be temporary. The LNG market price at which Asian demand began to fall was around 25$/MMbtu (85 €/MWh or 220p/Therm).

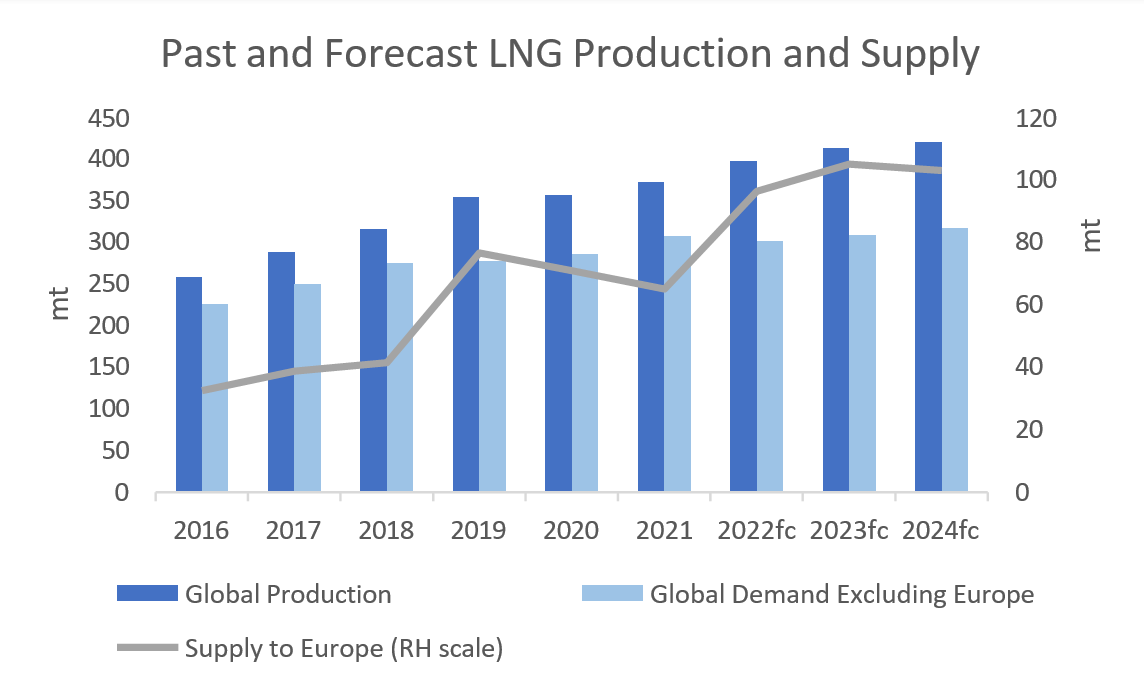

SGI’s forecast of future LNG flows to Europe – assuming that European prices remain high enough to outcompete Asian spot buyers – is shown in the chart below2.

The increase in LNG flow is around 35-40mpta or around 50bcm increased supply. Over the first months of 2022, LNG has indeed been arriving in Europe at this greatly increased rate. However, this forecast increase is the result of the difference between two large numbers – total global LNG production and non-EU LNG demand. It is therefore very sensitive to changes in either of these two inputs. If, for example, non-EU LNG demand were to recover to its trend growth rate of 6%, European LNG imports would not increase at all compared to 2021 levels.

2 Source: SGI Analysis, ENTSOG, IGU

The fragility of the flow of LNG to Europe is shown by the impact of the accident at the Freeport export facility in the USA in June. This removed just over 1mt per month of LNG from the market, and European imports in July and August fell by almost exactly the same amount.

Taking all different supply options together, SGI estimates that at current market prices Europe will attract around 60 bcm of additional supply to replace Russian volumes, compared to 2021 flows.

This is a significant volume, but still much less than the total shortfall from Russia – the remaining volumes will need to come from a reduction of demand.

European gas demand can be split into:

Residential – space heating for homes. Demand can be saved by reducing heating temperatures or by improved insulation.

Commercial – Usage by small businesses. Some of this is for space heating, and some are consumed in processes like cooking.

Industrial – use of gas by large customers in industrial processes (e.g. the chemicals, fertiliser or metals industries).

Power Generation – Use of gas for the production of electricity in competition with other fuels.

SGI has analysed gas consumption in 2022 to see how demand has changed in each of these sectors – as a response to high prices, the weather, or changes in the power industry. Overall, 2022 gas demand has reduced considerably as compared to 2021, and some countries are on track to meet

the EU’s voluntary target of a 15% demand reduction – but as the analysis below will show, some of this is due to warmer winter weather.

The residential sector is one of the largest consumers of gas, and demand is highly seasonal and strongly dependent upon winter temperatures. By analysing historically how demand in this segment has varied with temperature, SGI calculates that a 1°C reduction in winter temperatures leads to a 10bcm increase in gas demand and vice versa3. The weather over the first half of 2022 was much warmer than in 2021, leading to a decrease in gas demand of roughly 14bcm from temperature alone.

If households decide to heat their homes to a lower temperature, this has exactly the same impact as warmer temperatures i.e. a 1°C reduction in internal heating will result in a 10bcm saving in gas consumption. There is no precedent for how consumers might react when faced with very high heating costs, but a 1°C reduction does not seem unreasonable. Twenty years ago, internal spaces were heated to lower temperatures (typically 19C, vs 21C today) and people wore warmer clothing indoors during winter. A more accurate estimate of how much savings to expect from this sector will only be possible once the European heating season begins.

3 Source: The IEA has quoted a similar number

Greater savings would be possible if consumers were encouraged to improve building insulation, but SGI considers this unlikely to help much in the time frame of this analysis.

Data published by ENTSOG for Q3 gas consumption have proved especially valuable for estimating the impact of high prices on these segments since during this period there is almost no demand for heating. SGI obtained total gas demand data for the six largest European gas markets (Germany, UK, France, Italy, Netherlands, Spain and Belgium) and subtracted the demand from the power sector (using power generation data provided by ENTSOe and others). The resulting figure represents gas demand in the industrial and commercial segments. In Q3 2022, this demand was sharply down in 2021, with an average reduction of 12%.

| Gas Demand Reduction across France, Germany, Italy, Netherlands and UK % change 2022 vs 20214 |

| July | August | September | Total Q3 |

| -12% | -17% | -8% | -12%5 |

Extrapolating this result across Europe as a whole suggests that demand in these segments will fall by 25 bcmpa compared to 2021 due to high gas prices and/or lower economic activity. Demand can be expected to remain subdued whilst gas prices remain high.

This sector has the biggest potential for changes in gas demand but is also the most complex. Currently, gas is the most expensive source of power in Europe. Gas-fired generation is used to balance the market after generation from nuclear, renewables and coal have been despatched. This means that the demand for gas-fired generation is set by the total demand for power, with less generation from other power sources. Changes in any of these other parameters affect the demand for gas. In 2022, these changes have meant that despite the high cost of gas, usage of gas in the power sector has increased due to high generation in some countries (extreme heat in Southern Europe), low generation from hydro (drought) and nuclear power outages (technical problems and scheduled decommissioning).

In future years, gas demand will be determined by a complex interplay of the same factors. The table6 below shows SGI’s forecast for each of them.

4 Source: ENTSOG and ENTSOe; excludes Spain where the data appeared to be unreliable

5 Source: The IEA published a figure of a 20% reduction in industrial demand earlier this year

6 Source: SGI analysis based on data from ENTSOe and Ember

| Source | Possible Change TWh pa | Impact on Gas Demand | Comments |

| Total Power Demand | -80 (2%) | -80 | Higher prices should cause lower demand, but this is untested at current price levels. The EU Commission’s plan to reduce peak power demand by 5% will have a similar impact. Demand is also weather dependent. Over Q1-2, 2022 demand did not fall compared to 2021. |

| Wind + Solar capacity additions | +110 | -110 | Assumes capacity additions continue at the same average rate as 2012-2021 |

| Nuclear retirements in Germany reduced output in France | -145 | +145 | EDF forecast of Sept 13th for 2023/4 |

| Increased use of coal-fired capacity | +35 | -35 | Analysis by SGI of the current increase in major markets |

| Total Change in Gas Generation | -80TWh | Equivalent to 16bcm gas |

The combination of supply and demand responses results in around 60 bcm of additional supply and 50bcm of reduced demand, sufficient to replace around 110bcm of Russian gas in 2023. In future years, this number will increase by about 10bcm yearly, as additional renewable power capacity is added. The biggest contributions to securing the energy supply come from increased LNG supply, and energy conservation (both gas and electricity).

In 2023 the volumes are insufficient to fully offset the drop in Russian supply, with a shortfall of around 20bcm. However, by drawing on gas in storage, Europe should scrape by without resorting to rationing – assuming average weather. Some inland parts of Southeast Europe that are poorly connected to LNG supply routes may still experience problems, but the major markets of Western and Central Europe should remain supplied.

For this balance to be maintained European gas and electricity prices have to stay at the levels required for these supply and demand mechanisms to operate, namely high enough for Europe to continue to outcompete Asia for supplies of spot LNG and high enough to encourage the substantial saving of gas and power by households and small business.

| Item | Increase in Supply or Decrease in Demand 2023 vs 2021, bcm | Comments | |

| Supply | Non-LNG Supply | 8 | Norway, Azerbaijan |

| LNG | 50 | Assumes European prices continue to outcompete Asian marginal demand | |

| Demand | Residential | 10 | Reduced Heating/energy saving |

| Industry/Commercial | 25 | Demand Destruction | |

| Power-Gen. | 16 | See table above | |

| Total | ~110 |

The above estimates are subject to a great deal of uncertainty since the European gas, European electricity and global LNG markets have all entered unfamiliar territory. No one can be certain how they will respond to the current market stresses. These new uncertainties must be considered together with a traditional one – the weather. Cold weather in Europe increases gas demand for heating and increases demand for LNG in Asia. Wind speeds influence the power generation from wind and rainfall from hydro. Table7 shows the key uncertainties that could affect Europe’s gas balance shown below.

| Analysis of Major Uncertainties Affecting European Gas Balances |

| Uncertainty | Potential Impact on Gas Demand (delta to base case) | Comments |

| Cold/Warm Winter in Europe | +/- 20bcm | Based on the historical variability of heating demand |

| No Saving/Double forecast savings in gas demand at a given temperature | +/- 10bcm | REPower EU has a target of 10bcm. The recommendation by many countries to reduce heating to 19C would achieve a 20bcm saving, but some countries (notably the UK) have made little effort to influence consumers. |

| Variability of Renewable Energy Production due to wind, rain or sun | +/- 12bcm | Based on historical variability |

| 0%/4% reduction in power demand | +/- 16bcm | The EU is targeting a 5% reduction in peak demand and further reductions in overall demand |

| Russia completely stops gas supply to Europe | -10bcm relative to the analysis presented above | Russia may gamble on shutting off supply completely |

| Cold/warm Winter in Asia | +/- 10bcm | Based on historical variability, this results in less LNG for Europe |

| Asian LNG demand growth resumes, despite high prices | -50 bcm | Unlikely if LNG prices stay at current levels, but increasingly likely if they fall |

| Average LNG plant operating factors fall 2% | -10 bcm | In 2022 existing LNG plants have, on average, been operating strongly. A fall to early 2021 rates would reduce global LNG output by around 2%. |

| Total Range: | -140bcm to +70 bcm |

7 Source: SGI Analysis based on data from ENTSOe, ENTSOG, IGU inter al.

The uncertainty range is huge and easily sufficient to transform a forecast of adequate supply into a reality of either a physical shortage or a position of ample supply. Governments should plan for the worst – i.e. adverse weather or a resumption of Asian LNG demand. Every action taken will reduce the possibility of energy shortages and will reduce market prices for gas and power.

This document does not set out to exhaustively analyse all the measures already proposed by the various EU governments and the EU Commission – such as increasing the construction of renewable energy capacity and action to redistribute the windfall profits of power producers. Instead, it will focus on measures that are not being considered or where SGI considers that execution could be improved.

As was seen in the analysis presented in this document, energy conservation is one of the biggest levers at governments’ disposal to ensure gas supply. Most governments have adopted advertising campaigns urging citizens to save energy by heating less or reducing electricity consumption and have implemented these changes in public buildings. The UK government is a notable exception and is one of Europe’s biggest gas markets. The UK has limited gas storage, and in cold winters depends upon gas flows from continental Europe.

Therefore, it is very vulnerable to the downside scenario of a cold winter. In such a scenario, if the rest of Europe had made efforts to reduce gas demand whilst the UK had done little, continental Europe would be unlikely to help a country that had not helped itself.

The table presented above showing the uncertainty and variability of the gas supply situation shows the need to increase Europe’s capacity to store gas. SGI has previously published material demonstrating that increases in renewable energy production, increased dependence on LNG and decreased coal production will greatly increase the volatility of gas supply and demand. This volatility will increase further if Russian supply, previously an important balancing factor for the market, is not available. The volume of gas Europe can store is small compared to the uncertainties that the market faces. In the event of a favourable situation (warm winters, low Asian LNG demand) in any future year, Europe needs the ability to store excess gas and not be limited by storage capacity constraints as it was during the oversupplied market in 2020.

As seen from the analysis above, short-term securing of supply and mid-term rebalancing of the global gas market, leading to lower gas prices, both depend upon the LNG market. High market prices have allowed many US LNG projects to secure the long-term sales contracts they need to make considerable progress towards “FID” (a final investment decision when construction contracts are awarded). Unfortunately, these sales contracts are usually with Asian buyers (in particular China) or LNG traders. Very few contracts have been concluded with European utilities, meaning that less US LNG capacity will be built than would be justified by

Europe’s ongoing need for volumes, and that supply to Europe will continue to depend largely upon decisions made by LNG traders, who will compare the spot prices available in Europe vs those offered by the rest of the world. This in turn could mean that European gas prices will need to remain high for it to continue to be able to pull spot LNG supply out of Asia. European governments should encourage their utilities to contract for LNG from new projects and could also encourage their banks and investment agencies to provide financing.

Support for projects producing fossil fuels may be politically difficult, but only when the LNG market comes back into balance can European gas prices return to more normal levels. It should also be noted that in the medium-term increased LNG supply and lower prices will have two other benefits:

Conclusions: