In the intricate web of the global economy, energy trading plays a pivotal and often underestimated role, dictating the intricate trade of resources that power industries, businesses, and households around the world. It’s more than just transactions on a screen; it’s what goes on in the background, that enables lights to switch on, machines to work, and economies to thrive. This article takes you deep into the heart of energy trading, shedding light on its fundamental concepts, exploring its economic viability, delving into the enticing investment opportunities it offers, and providing a panoramic view of the current global landscape.

At its core, energy trading is the pulse that propels the modern world forward. Imagine the vast networks of pipelines, power lines, and digital connections that crisscross the globe. They’re the arteries through which energy flows, driving progress and prosperity. In this complex ecosystem, the movement of energy commodities is orchestrated with precision, resembling a grand symphony where supply, demand, pricing trends, and geopolitical currents harmonize to create the melodies of modern civilization. Energy trading is more than just buying and selling; it’s a finely tuned art that involves predicting the unpredictable and navigating the uncharted. Traders, armed with information and insights, maneuver through intricate patterns of market behavior’s, seizing opportunities, and managing risks in a realm where the tiniest fluctuations can send shockwaves across continents. It’s a world where the price of a barrel of oil, the cost of a megawatt-hour of electricity, or the value of a carbon credit can be the catalyst for monumental decisions that reverberate across industries and governments.

Energy trading goes beyond just numbers on a spreadsheet. It involves various factors that can lead to great wealth and impact economies. Essentially, energy trading is driven by the balance between supply and demand, creating price fluctuations and opportunities that skilled traders can take advantage of. In this high-stakes environment, the interaction of supply changes, geopolitical tensions, and unpredictable weather patterns creates a dynamic landscape where prices constantly fluctuate. When geopolitical events disrupt resource flow, storms affect production, or new discoveries flood markets, these changes have a ripple effect on trading and digital screens, causing price variations that can be gentle or intense.

One of the foundational strategies in energy trading is the principle of arbitrage. This strategy capitalizes on price differentials between various markets, exploiting the gaps that emerge due to geographic, logistical, or even regulatory factors. A barrel of oil might have a different value in one region compared to another due to transportation costs, taxation, or even the availability of infrastructure. Savvy traders adeptly navigate these nuances, buying low in one market and selling high in another, effectively bridging the gap and reaping profits. Nevertheless, there are risks involved in navigating price fluctuations. Energy markets are known for their unpredictability, as stable prices can quickly change due to geopolitical changes or unforeseen technological advancements. This is where risk management becomes essential. Successful risk management involves hedging positions, diversifying portfolios, and being ready for different scenarios. Traders utilize financial tools such as options and futures contracts to protect against negative market shifts, preventing significant losses from a single mistake.

Price speculation is an important skill in energy trading. Traders need to analyze current market trends and predict future price movements. This requires a combination of market knowledge, economic understanding, and intuition. Successful traders are like financial meteorologists, using data analysis to forecast upcoming market conditions. Energy trading is an attractive opportunity for making profits in the ever-changing economic landscape. Success in this field hinges on the ability to predict and adapt to price fluctuations. Astute traders leverage their understanding of supply chains, geopolitical factors, and even weather patterns to navigate the unpredictable market.

Energy trading, once confined to the realm of large corporations and financial giants, has democratized its doors, inviting individuals and institutions of all sizes to partake in its potential riches. Beyond the trading floors and digital screens, a world of investment opportunities has emerged, allowing a diverse spectrum of investors to tap into the energy market’s potential.

Traditionally, investing in energy commodities like oil, natural gas, or electricity might have been associated with the complexities of physical ownership and storage. However, the financial landscape has evolved, introducing a plethora of investment instruments that provide exposure to energy commodities without the logistical intricacies.

One of the primary vehicles for energy trading investment is through futures contracts. These contracts allow investors to speculate on the future price of commodities like oil or natural gas. By agreeing to buy or sell a certain amount of a commodity at a predetermined price on a specific future date, investors can capitalize on price movements without physically owning the asset.

Options provide an additional layer of flexibility. They give investors the right, but not the obligation, to buy or sell a commodity at a predetermined price within a specified timeframe. This allows investors to mitigate risk or take advantage of price fluctuations with a relatively smaller upfront investment compared to owning the underlying asset outright.

ETFs have emerged as a popular route for investors seeking exposure to energy markets. These funds pool resources from multiple investors to invest in a diversified portfolio of energy-related assets. An energy-focused ETF might include a mix of companies engaged in exploration, production, distribution, or even renewable energy. This diversification spreads risk while providing a simplified way to access the potential of the energy sector.

Indices and mutual funds also offer ways to gain exposure to energy markets. These vehicles allow investors to invest in a broader basket of energy-related assets, reducing the risk associated with individual company performance. Indices track the performance of a specific sector of the market, while mutual funds are managed by professionals who make investment decisions on behalf of the fund’s investors.

With the advent of technology, digital platforms and apps have made it easier than ever for individual investors to participate in energy trading. These platforms provide user-friendly interfaces, real-time data, and educational resources, empowering individuals to make informed investment decisions and actively manage their energy trading portfolios.

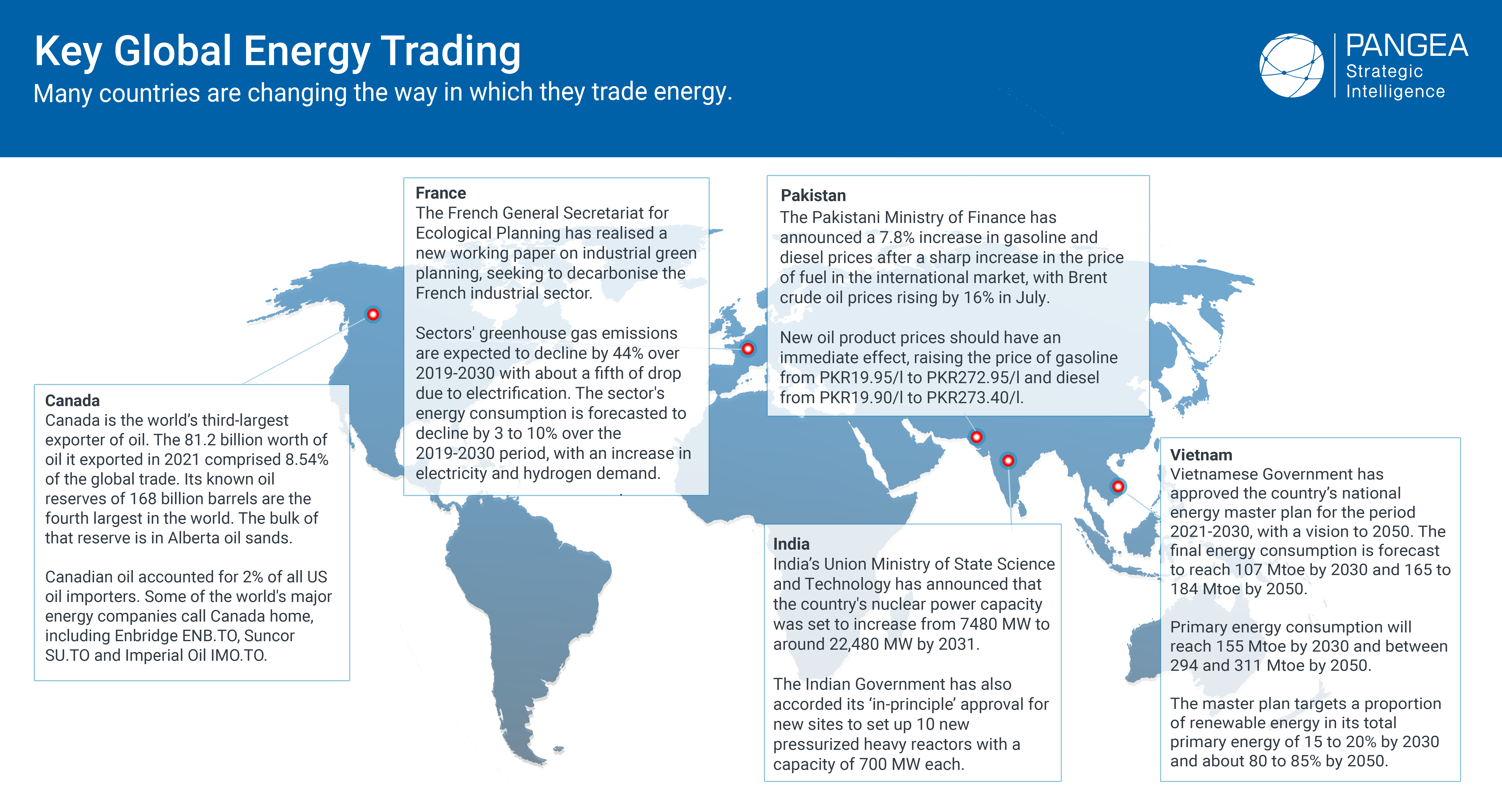

The landscape of energy trading varies across the globe. Regions rich in fossil fuels hold traditional energy trading strong, while others focus on renewable energy sources. Key markets like the United States, Europe, and Asia exhibit diverse approaches to energy trading, shaped by geopolitical factors and policies. International agreements and regulations, such as emissions targets, also influence trading practices, propelling the industry toward sustainability.

Certainly, here are a few real-world examples of energy trading that highlight different aspects of the practice:

Enron Corporation, once a major American energy company, was known for its aggressive energy trading strategies. Enron’s traders engaged in complex deals, exploiting regulatory loopholes and manipulating prices. They created artificial shortages of electricity in California, driving up prices and causing rolling blackouts. The company’s unethical practices were eventually exposed, leading to its bankruptcy in 2001 and one of the largest corporate scandals in history.

During the harsh winter of 2014, the polar vortex caused a surge in demand for natural gas for heating purposes across the United States. Traders who foresaw the increased demand strategically bought natural gas futures contracts, anticipating higher prices. As a result, they profited from the price spike, showcasing how accurate predictions about supply and demand dynamics can lead to successful energy trading strategies.

Renewable Energy Certificates (RECs) are a form of energy trading in the realm of renewable energy. When a renewable energy source generates electricity, it also generates RECs, which represent the environmental attributes of that renewable energy generation. These certificates can be traded in the market. Companies looking to meet renewable energy targets or showcase their environmental commitment can purchase RECs to offset their conventional energy usage.

In early 2020, a combination of factors, including a price war between major oil-producing countries and the COVID-19 pandemic’s impact on global demand, led to a historic crash in oil prices. Energy traders who had positioned themselves for lower oil prices using futures contracts benefited from this dramatic price decline. However, those who were caught on the wrong side of the market faced significant losses.

As renewable energy sources like solar and wind become more prominent, energy trading has extended to include strategies involving battery storage. For instance, traders can buy electricity from the grid when prices are low and store it in batteries, then sell it back to the grid when prices peak. This not only allows for profit from price differentials but also contributes to grid stability by balancing supply and demand.

In the realm of environmental responsibility, carbon emissions trading has gained traction. Countries or organizations are allocated a certain number of carbon credits, representing their allowable emissions. Those who emit less than their quota can sell excess credits to those exceeding their limit. The European Union’s Emissions Trading System (EU ETS) is one of the largest carbon trading markets in the world.

These examples showcase the diverse facets of energy trading, from manipulating markets for unethical gains to capitalizing on accurate predictions, adapting to market disruptions, exploring renewable energy markets, leveraging battery storage, and participating in environmental initiatives. Energy trading is a multifaceted field that demonstrates the significant impact it can have on economies, industries, and the environment.

Energy trading isn’t without its challenges. Market volatility, regulatory shifts, and environmental concerns pose risks that traders must navigate. The disconnectedness of global energy markets means that disruptions in one part of the world can have far-reaching effects. To mitigate these risks, diversification and a deep understanding of market dynamics are essential.

Energy markets can be highly volatile, with prices fluctuating rapidly due to factors such as geopolitical events, weather patterns, and changes in supply and demand. Traders need to closely monitor these market movements and have strategies in place to manage risks and capitalize on opportunities.

Government policies and regulations can have a significant impact on energy markets. Changes in regulations related to emissions, renewable energy targets, or subsidies for certain types of energy can create uncertainty and affect trading strategies. Traders need to stay updated on regulatory developments and adapt their strategies accordingly.

Increasingly, environmental considerations are shaping energy markets. Concerns about climate change and air pollution have led to a greater focus on renewable energy sources and efforts to reduce carbon emissions. Traders need to factor in these environmental factors in their decision-making and identify opportunities in the growing clean energy sector.

Energy markets around the world are interconnected, meaning that disruptions in one region can have ripple effects on other markets. Events such as natural disasters, political instability, or supply disruptions can lead to price spikes or supply shortages. Traders need to be aware of these interconnections and consider global factors in their trading strategies.

To mitigate risks, energy traders often diversify their portfolios by trading a range of energy commodities, such as oil, natural gas, electricity, or renewable energy certificates. Diversification can help spread risks and prevent heavy losses in case of adverse market conditions. Traders need to analyze the different energy markets and identify opportunities for diversification.

Successful energy traders have a deep understanding of market dynamics, including supply and demand fundamentals, price drivers, and geopolitical factors. They closely monitor market trends, conduct a thorough analysis, and stay updated on relevant news and events. This knowledge enables them to make informed trading decisions and identify profitable opportunities.

Energy trading involves inherent risks, and effective risk management is crucial. Traders use various risk management techniques, such as setting stop-loss orders, using hedging strategies, and closely monitoring exposure to market fluctuations. They also conduct thorough risk assessments and develop contingency plans to mitigate potential losses.

The energy trading landscape is becoming increasingly digital, with advanced technologies and data analytics playing a crucial role. Traders rely on sophisticated trading platforms, algorithms, and data analysis tools to analyse market trends, identify patterns, and execute trades. Keeping up with technological advancements is essential for staying competitive in the energy trading industry.

Energy trading stands as a dynamic realm where economic forces, technology, and environmental considerations intersect. As the world seeks sustainable energy solutions, the trading landscape will continue to transform. Understanding the intricacies of energy trading is not only crucial for businesses but also offers investment opportunities for those seeking to navigate the complex world of global energy markets. Staying informed about evolving trends and leveraging the power of technology will be key to unlocking success in this ever-changing field.