The unity of the OPEC+ group has proved to be fragile and following the deterioration of relations between Russia and Saudi Arabia at its most recent meeting, we now see oil markets descending into a period of mutually assured destruction. A flood of supply as well as a demand collapse due to COVID-19 has seen price per barrel fall to less than $30.

In short, the Saudis’ promise to increase crude oil output after Russia refused to cooperate on cutting their own production, has sent crude oil prices plunging, the sharpest decline observed on the market since the Gulf War in 1991. Ultimately, it boils down to two powerhouse nations being unable and/or unwilling to compromise and/or communicate effectively. As always, with scenarios such as these, those lower down the ladder will suffer most in the medium to long term – in this case, the smaller, less-influential OPEC+ nations.

The story behind how Russia and Saudi Arabia got to this point is interesting and complex, with several contingent collisions and a domino effect of events. It did not take long for oil prices to drop once the news of the novel and highly infectious coronavirus began emanating from China at the beginning of 2020, in anticipation of decreased demand as COVID-19 depressed output. Indeed, whilst Chinese authorities were shutting production facilities in an effort to quell the spread of the disease, oil demand in the country dropped dramatically. This lead to Saudi Arabia calling for the group to be brought together ahead of schedule and pushing for collective production cuts of 1.5m barrels per day to be shared by OPEC+ nations.

When agreement on a reduction of 1.2m bpd had been reached, Russia wanted more of the burden to be borne by different players and refused to contribute the final 300,000 barrels. Many Experts suggest, counterintuitively, that this was because Russia felt the reduction wasn’t sufficient, believed a reduction of several million bpd would be needed to hold the price in the face of prolonged demand slide. Nonetheless, once a crack emerged, and Russia, seemingly being guided by Rosneft CEO, Igor Sechin, went against the group, the Saudi’s were incensed and abandoned any form of negotiated reduction. This left all the parties going the opposite way to the direction they initially wanted.

Saudi Arabia’s Energy Minister Prince Abdulaziz bin Salman said on state television that “Every oil producer in the free market can take care of their own market share.” Aramco’s decision to increase oil output during the COVID-19 pandemic will flood global energy markets and exert egregious pressure on prices.

The price of oil could slip to lower than twenty dollars a barrel. It could go all the way to zero. Negative gas prices have been seen in the past when there has been too much of it. If COVID-19 keeps the world on lockdown, then taking oil out of the ground with nobody to buy it and nowhere to store it means there is no reason to imagine we are near the price floor yet.

Russia and Saudi Arabia are pursuing all-out price and supply war hoping to grab market share and possibly even force the other out of business. Many Experts expect Russia to back down, because in a totally free market Saudi will win. Saudi may have a higher fiscal break-even point than Russia, thus, requiring higher prices, but Russia are under sanction so will find it harder to borrow. Russia also has fewer friends on the international stage and a larger population.

This is the lowest prices have been in 17 years, and Russia and Saudi Arabia’s respective economies could be facing one of their gravest, most serious tests in history: will their fiscal cushioning withstand the shock of the crash in oil prices?

Saudi Arabia has vowed to cut its budget by five per cent in a bid to deal with both COVID-19 and low oil prices, a move redolent of their decision to cut national spending after the oil price crash of 2014–15, which also entailed the suspension of payments worth tens of billions of dollars to contractors. On March 20th, the Saudi Minister of Finance Mohammed al-Jadaan unveiled a $32 billion package designed to help businesses and calm nerves. In fact, he insisted that not only was the country prepared to double their debt, but also that contractors would receive payments owed.

Meanwhile in Moscow, some Russians believe that the Saudis are ultimately unprepared for a long-term oil war, despite the Gulf nation’s superior production capacities and greater ability to manipulate the market. The Saudi economy, they believe, is more dependent on oil than is Russia’s. Furthermore, it is thought that the Russian budget can still be in surplus with oil prices of $42 per barrel, whereas the Saudis would require prices of at least $60 and, some say, $80 per barrel. Russia also has larger reserves to draw on.

Leading Expert opinion is that the Russians made a misjudged powerplay and that their bluff has been called. Despite having some factors in their favour, more of the macro goes against them than for them in a war of attrition.

It is undoubtedly true that Russia and Saudi will both sustain a lot of damage and absorb a significant amount of pain in the coming months. Eventually, though, they will find a way to de-escalate this situation, and will hope to do so with as little public embarrassment as possible. They will bounce back. However, smaller, less influential OPEC+ nations will suffer most. They are powerless to impact the crisis and drive the price, but face tremendous hardship if price stays this low or goes even lower. Several could be forced out of the market. They can’t continue to compete with price drops for any, even remotely sustained period. The collateral effects of this game of chicken will not impact the reckless major players as negatively as it does those around them.

With their hands being forced, other OPEC+ nations are also increasing production. The UAE’s national oil company is to raise its crude supply in April to over four million barrels per day and plans to accelerate its plans to boost capacity by a further million, a target hitherto projected for 2030. By raising output, Abu Dhabi and Riyadh will add a combined 3.6 million barrels per day in April to a market that is already swimming in crude, in comparison to their current output which has been limited by the pact with Russia that is due to end this month. Nigeria is pursuing a similar path.

China is a good place to start from both a COVID-19 and an oil perspective. The implementation of unprecedented measures to confine the population in Wuhan – where COVID-19 originated – and other regions, has created societal and economic pain. These aggressive and quick response strategies have provided a roadmap for other nations to follow, as well as a forecast for the impacts that may be felt in other countries.

Huge numbers of people and multiple industries have been struck hard. Economically, both demand and supply have been affected. China’s transport sector, which heavily relies on oil, has taken the brunt of the hit.

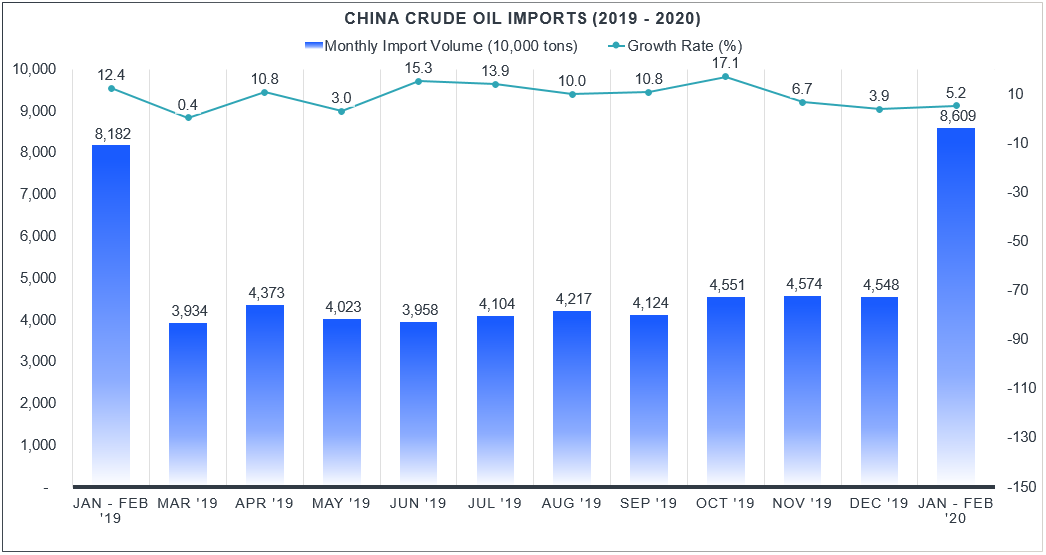

From an oil perspective, China is a barometer for the fall in demand that is likely to occur in other countries. China itself is also an important market for oil. The International Oil Agency’s Oil Market Report, published March 6th, served to underscore the significance of China’s role in oil consumption. The country accounts for 14 per cent of global demand and over 80 per cent of global growth in demand.

China makes up a much larger proportion of the world economy today than it did in 2003. It constitutes the world’s second largest economy and serves as the world’s top exporter, second only to the US. In terms of oil, it has strong strategic reserves, and in 2019 over 70% of its oil was imported from Saudi Arabia and Russia. China is the world’s biggest crude importer and, despite its investment in economic development, the country’s growth rate is at around just six per cent, its lowest since 1990.

Source: Energy production in the First Two Months of 2020, The National Bureau of Statistics of China (March, 2020)

The oil demand outlook remains weak and the growing spread of COVID-19 has not created any more certainty to purchasing or supply tender commitments.

Saudi Arabia’s announcement of massive cuts to its official prices for Arab Light, their main export grade, was met with jubilation by its biggest buyers, namely China, India and South Korea.

Despite the oil price plunge providing relief for China and many other countries, China remains selective and seems adamant in achieving energy security through multiple suppliers. Sinochem, the state’s oil and chemicals company, decided not to purchase from Russia’s Rosneft Oil Company, possibly in part because of US sanctions imposed on the Russian oil giant.

The report of new local infections has decreased and there is a glimmer of economic recovery. Many of China’s independent refiners have taken advantage of the cheap crude, and run rates are looking more positive. When quarantine measures are lifted and further milestones are reached, such as zero new local infections, there is likely to be less caution around crude purchases.

The SARS outbreak of 2003 led to 8,000 people being infected and 800 deaths worldwide. Economically speaking, it knocked 0.5–1% off China’s growth in 2003. At the time, China held a smaller share of the global economy, and the effects we further mitigated because the disease didn’t spread as rapidly across the globe as has COVID-19. In 2020, before the outbreak of Coronavirus, China’s Purchasing Managers’ Index was signalling contraction, with a February reading down to 35.7 from 50, roughly equivalent to that of 2008’s global financial crisis. COVID-19’s subsequent economic fallout could hamper the growth of the Chinese economy further, making any marginal gains from the oil price collapse insignificant.

The state of US relations with both Russia and Saudi Arabia is well-documented and was, frankly, difficult enough without adding this oil war to the list of things to navigate.

On March 18th, 12 US Senators penned an open letter to the Saudis, urging them to end the so-called ‘oil war’ with the Russians in order to revitalise the financial market. Led by Kevin Cramer (North Dakota) and Dan Sullivan (Alaska), the legislators opined that the extremely unsettled and volatile global oil market, stricken as it is by plummeting oil prices, would be a very much ‘unwelcome development’ as economies the world over grapple with the COVID-19 pandemic. They wrote:

“The US has been a strong and reliable partner to the Kingdom for decades. In light of this close strategic relationship, it was greatly concerning to see guidance from the Kingdom’s energy ministry to lower crude prices and boost output capacity. This has contributed to a disruption in global oil prices on top of already hard-hit financial markets.”

The Senators called on Riyadh to employ constructive leadership, reiterating senior Saudi leaders’ own words that the country is a force for stability in the world’s oil market.

Cheaper oil will act almost like a tax cut for consumers, especially in the US where the costs of raw material constitutes a far greater share of the retail cost at the pump than in Europe. This news was taken as at least some compensation for the almost incalculable losses directly caused by COVID-19. This will probably push down petrol prices for Americans, for whom a gallon of regular unleaded has dropped by seven cents in just one month. Though, that is of debatable value for consumers at a time when travel and movement are so heavily restricted.

Donald Trump may well benefit from cheap petrol, too, as he heads toward November’s general election in the wake of COVID-19’s economic destruction. Trump may have also done oil producers a favour by imposing sanctions on Venezuela and Iran, both of whom are members of the Organization of the Petroleum Exporting Countries. However, the fight has complex – likely damaging – implications for the US shale industry, which has been propped up by private equity since the last crash in 2014, and now looks in major trouble again.

Nonetheless, regardless of pressure from even the most powerful actors in the international community, it looks like the flood of oil will continue, at least until Russia backs down – perhaps at the next scheduled OPEC meeting in June – but demand is not likely to increase anytime soon. Generally, low price increases demand. COVID-19 means that isn’t happening. Therefore, the oil market finds itself in an unprecedented situation.

As the globe waits in fear of a recession, the Middle East and North Africa (MENA) could be hardest hit by what is debatably a perfect storm, namely the spread of the virus to the region and the concurrent collapse of oil prices. In MENA, plummeting oil prices will hurt oil exporters and importers alike, and the battle will be made more convoluted by empty government coffers. International support will surely be crucial. Collapsing oil prices have been unsettling financial markets already rocked by the COVID-19 pandemic. A decline in oil stocks indicates the market perception of a persistent decrease and that the so-called ‘oil war’ will impact higher-cost production most heavily.

It would seem there are three possible scenarios for how COVID-19 could evolve in the coming months:

Scenario #1: Quick Recovery

The first scenario entails the virus transpiring to be predominantly seasonal and causing a fatality ratio similar to that of the flu. Global public health responses would need to be as effective as they have been in China. Moving forward, there would be a relatively rapid rebound after the initial plummet in consumer demand. The economic slowdown in Europe and the US would last until the end of Q1, and impacts of various degrees would be observed elsewhere, in Asia, MENA and South America.

Scenario #2: Global Slowdown

In the second scenario, it would transpire that global public health responses were actually less effective than those employed in China. The fatality ratio would be roughly equal to or higher than that of the flu, contingent on said public health responses. The impact would be primarily localised to the US and Europe, and there would need to be a far greater shift in people’s daily behaviours than is currently being observed and legislated for. China’s recovery might have largely completed come the beginning of Q2, but Europe’s and the US’s economic slowdowns would last until at least mid-Q2. There would be more varied impacts observed in Asia, MENA and South America. Some sectors, including hospitality and aviation, would be severely hit, and others such as consumer packaged goods would experience an initial acute drop but then recover by the end of Q2.

Scenario #3: Record Global Pandemic

The final scenario would entail public health responses around the world being far less effective than that implemented throughout China. The coronavirus would not transpire to be seasonal, so its transmissibility would not decline with the northern hemisphere’s spring. The fatality ratio would be higher than that of the flu, either because of the disease’s hitherto-unknown characteristics or the inadequacy of global health systems. A continued case growth count would be observed through into Q3.

Somewhat counterintuitively, China’s recovery would perhaps serve only to increase transmission and lead to a potential case resurgence. A global recession would ensue, with economic slowdown the world over. Consumer confidence would not come close to recovering until the end of Q3 at the latest.

Assessing the economic impact of coronavirus on the economy doesn’t just entail focusing on COVID-19’s epidemiological profile, but also on how businesses, governments and consumers may respond to its devastation. COVID-19 will surely shape economic losses through demand, financial markets and supply chains, impacting household consumption, business investment and international trade. Furthermore, it will introduce havoc not only in a traditional supply-and-demand manner, but also by virtue of the extreme levels of uncertainty it will introduce to the world’s economies.

As the globe waits in fear of a recession, MENA could be hardest hit by what is debatably a perfect storm: the spread of the virus to the region and the concurrent collapse of oil prices. In MENA, plummeting oil prices will hurt oil exporters and importers alike, and the battle will be made more convoluted by empty government coffers. International support will surely be crucial.

According to Kristalina Georgieva, Fund Managing Director at the International Monetary Fund, the global health emergency that the COVID-19 pandemic represents may just be the ‘most pressing uncertainty’ in modern history. This is reflected in the exacerbated volatility and lower valuations being witnessed in financial markets.

Will market responses be enough to keep the economy afloat? The onus would surely appear to fall on policymakers to implement procedures with the greatest haste in order that the fallout from the coronavirus and COVID-19 be alleviated. The Federal Reserve has already done a sterling job in aggressively cutting interest rates, but the US’s monetary policies will probably have little effect, as interest rates there are already so low and have been for some time.

The exact effects to be observed in the coming weeks and months are impossible to project, such is the vastness of this unknown, but one thing is for certain: COVID-19 is a tremendous risk to the global economy.

The thing is, oil, as a commodity, is so interwoven with every aspect of the global economy that this crisis has wide-ranging implications for credit markets and the wider Energy Transition. Different governments will have different views on what stimuli are required to re-ignite the economy after COVID-19. Part of the oil drop in price is related to the severe economic contraction that the global economy is going through, as it compounds the impact of increased supply. More generally, this economic shrinking means governments are dealing with a lot of very immediate pressures, and during times where staying afloat is paramount, investment in anything that is not immediately essential – for example, things like climate change policy and investment in renewables projects – will fall by the wayside.